Johnson & Johnson’s Business Segments in 1Q17

Johnson & Johnson’s business includes three segments: Pharmaceuticals, Consumer, and Medical Devices.

May 30 2017, Updated 5:05 p.m. ET

Business segments

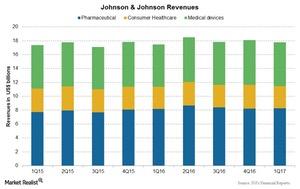

Johnson & Johnson’s (JNJ) business includes three segments: Pharmaceuticals, Consumer, and Medical Devices. Given its operational growth across all segments, the company reported operational growth of 2% in revenue to $17.8 billion in 1Q17.

Pharmaceuticals segment

JNJ’s Pharmaceuticals segment contributes over 45% of its total revenue. The segment’s revenue was ~$8.3 billion in 1Q17, a rise of ~1% compared to its 1Q16 revenue. The segment reported an operational rise of 1.4%, offset by the 0.6% negative impact of foreign exchange. Its growth was driven by the strong performances of its oncology and immunology products in the quarter.

Consumer segment

The company’s Consumer segment reported revenue of ~$3.2 billion in 1Q17, a 1.0% rise compared to 1Q16. The segment reported an operational rise of 0.8% and a positive currency impact of 0.2% during 1Q17. The strong performances of its over-the-counter products and beauty products were substantially offset by lower sales in other franchises in the quarter.

Medical Devices segment

The Medical Devices segment contributes ~35% of JNJ’s total revenue. The segment’s revenue was ~$6.3 billion in 1Q17, a 3% rise over 1Q16. The segment reported a ~3.4% operational rise, partially offset by the 0.4% negative impact of foreign exchange. Recent changes in the Medical Devices segment, including the acquisition of Abbott Medical Optics in February 2017, were responsible for its growth.

To divest risk, investors can consider ETFs such as the iShares S&P Global Healthcare ETF (IXJ), which holds 7.7% of its total assets in Johnson & Johnson. The iShares S&P Global Healthcare ETF also holds 4.9% of its total assets in Novartis (NVS), 4.4% in Merck & Co. (MRK), and 2.5% in AbbVie (ABBV).