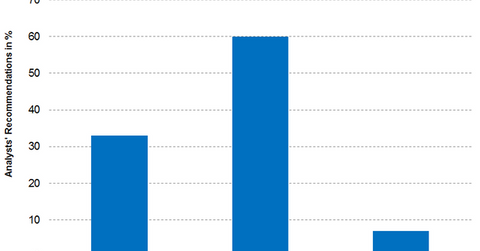

Analysts’ Recommendations for IFF after Its 1Q17 Earnings

As of May 9, about 33% of the analysts recommended a “buy” for International Flavors & Fragrances, 60% recommended a “hold,” and 7% recommended a “sell.”

May 11 2017, Updated 7:36 a.m. ET

Analysts’ recommendations

As of May 9, 2017, 15 brokerage firms were actively tracking International Flavors & Fragrances (IFF) stock. About 33% of the analysts recommended a “buy,” 60% recommended a “hold,” and 7% recommended a “sell.”

Analysts’ consensus indicates a 12-month target price of $134.77 for International Flavors & Fragrances. The target price indicates a 12-month return of 4.5% from the closing price of $128.98 as of May 9, 2017.

Target prices

The recommended target prices for International Flavors & Fragrances from some well-known brokerage firms are as follows:

- J.P. Morgan (JPM) rated International Flavors & Fragrances as “neutral” with a target price of $123, which implies a 12-month return of -4.6% based on the closing price of $128.98 as of May 9, 2017.

- UBS (UBS) rated International Flavors & Fragrances as a “buy” with a target price of $138, which implies a 12-month return of 7.0% based on the closing price of $128.98 as of May 9, 2017.

- Barclays (BCS) rated International Flavors & Fragrances as “underweight” with a target price of $112, which implies a 12-month return of -13.10% based on the closing price of $128.98 as of May 9, 2017.

Investors can indirectly hold International Flavors & Fragrances by investing in the Vanguard Materials ETF (VAW). VAW has invested 1.30% of its holdings in International Flavors & Fragrances as of May 2, 2017.