These 5 S&P 500 Utilities Offer Highest Dividend Yields

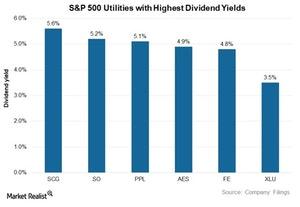

The Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, is currently trading at a dividend yield of 3.5%.

Nov. 20 2020, Updated 11:48 a.m. ET

Utilities’ premium yield

The utilities sector continues to be one of the top-yielding sectors among broader markets. The Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, is currently trading at a dividend yield of 3.5%. It’s trading at a large premium to broader markets (SPX-INDEX) (SPY) and even to Treasury yields (TLT).

US utilities seem fundamentally strong going forward. The industry’s expected average earnings growth rate is near 5% per year. Utilities’ expected annual per share dividend growth is also ~5%. Considering their fair earnings and dividend growth going forward, utilities might continue to be among the top-yielding sectors.

Top-yielding utilities

Utilities we have considered in this series yield way higher than the industry average. SCANA (SCG) is currently trading at a dividend yield of 5.6%, the highest among stocks in the S&P 500 Utilities Index (XLU). At the same time, Georgia-based Southern Company (SO) offers a dividend yield of 5.2%. NextEra Energy (NEE), the largest utility by market capitalization, is presently trading at a dividend yield of 2.6%, lower than the industry average.

Utility stocks have dropped by more than 12% in the last one month. Gradual interest rate hikes and less beneficial tax reforms created the weakness in the sector. Premium valuations exacerbated this weakness. In the same period, the SPDR S&P 500 (SPX-INDEX) (SPY) rose by more than 5%.

Let’s begin by looking at SCANA’s dividend profile in the next part.