SCANA Corp

Latest SCANA Corp News and Updates

What’s in Store for Dominion Energy Stock?

Dominion Energy (D), one of the laggards among top utilities this year, seemed strong lately and is currently trading close to an eight-month high.

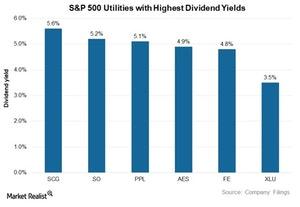

These 5 S&P 500 Utilities Offer Highest Dividend Yields

The Utilities Select Sector SPDR ETF (XLU), which tracks the S&P 500 Utilities Index, is currently trading at a dividend yield of 3.5%.