What’s Vale’s Base Metals Outlook?

As we saw in the previous two parts of this series, Vale’s (VALE) iron ore and coal production increased sequentially in 2Q17.

Aug. 10 2017, Updated 10:37 a.m. ET

Base metals production lower as anticipated

As we saw in the previous two parts of this series, Vale’s (VALE) iron ore and coal production increased sequentially in 2Q17. The base metals production was, however, an exception as it fell quarter-over-quarter. Nickel production fell 7.7% sequentially to 65,900 tons, which was mainly due to the rebuilding of furnace two in advance transition to a single furnace operation and also due to the scheduled maintenance shutdown at Sudbury. Vale’s copper production was also 6.2% lower quarter-over-quarter to 100,800 tons in 2Q17. The scheduled maintenance shutdown at Sudbury was the main reason for lower copper production.

Vale’s management anticipated the production declines in nickel and copper production in 2Q17 due to the transition to a single furnace operation at Sudbury and a maintenance shutdown.

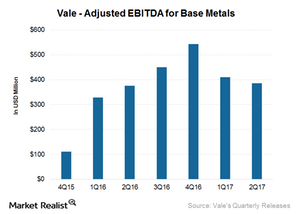

Base metal EBITDA fell too

The company’s base metals’ adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) fell by $24 million as compared to 1Q17 at $386 million. The decline in EBITDA is mainly attributable to the lower realized prices for nickel and copper offset to some extent by lower expenses, favorable volumes, and favorable exchange rate variation.

Vale’s base metal commentary

Vale commented that nickel prices fell by an average 10.2% during 2Q17 due to:

- weaker demand from China

- uncertainty in nickel ore export volumes from Indonesia

The average London Metal Exchange (or LME) copper prices also fell 3% in 2Q17 to $5,662 per ton. Vale believes that the supply disruptions for copper have stabilized for copper in 2Q17 relative to 1Q17. On the demand side, the company noted that while copper concentrate imports into China rose 2% in the first five months of 2017 versus the first five months of 2016 due to ongoing smelter capacity expansion, the imports of refined copper (DBC) have fallen 28% over the same period as scrap continues to displace refined material.

During its 1Q17 results, Vale had maintained that the long-term outlook for copper remains positive as the outlook for future supply remains constrained due to declining grades and deferred capital investment. Such an outlook would be positive for the stock prices of all copper producers including Teck Resources (TCK), Southern Copper (SCCO), and Freeport-McMoRan (FCX).

In the next part, we’ll take a look at Vale’s balance sheet.