Crude Oil Traders Track Venezuela’s Oil Production

The EIA estimates that Venezuela’s crude oil production increased by 15,000 bpd to 1,620,000 bpd in February 2018—compared to January 2018.

March 13 2018, Updated 11:50 a.m. ET

Venezuela’s crude oil production

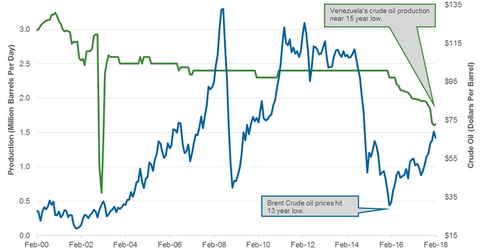

Venezuela is OPEC’s sixth-largest crude oil producer. The EIA estimates that Venezuela’s crude oil production increased by 15,000 bpd (barrels per day) to 1,620,000 bpd in February 2018—compared to January 2018. However, production has dropped by 370,000 bpd or 19% year-over-year. Crude oil production is near a 15-year low.

Venezuela’s high debt, lack of investment in the oil exploration and production activity, electricity disruptions, and high inflation have pressured the oil production activity. A drop in Venezuela’s production partly supported crude oil prices.

Brent crude oil prices and Venezuela’s production

Venezuela’s oil production declined 52.5% or by 1,790,000 bpd from its record high in December 1997. Production has declined by 680,000 bpd or 30% in the last two years. Brent and WTI crude oil prices advanced ~96% and ~103% during the same period.

The United States Brent Oil ETF (BNO) and the United States Oil ETF (USO) track Brent and WTI crude oil futures, respectively. These ETFs have increased ~56.1% and ~37.4%, respectively, in the last two years.

The Energy Select Sector SPDR Fund (XLE) and the Vanguard Energy ETF (VDE) have increased ~18% and ~17%, respectively, in the last two years. XLE tracks the performance of the Energy Select Sector Index. VDE tracks the performance of an index of energy stocks.

Impact

Venezuela’s oil minister expects that the country’s oil production could rise by ~1,000,000 bpd. However, high debt and an economic crisis have led to lower production in the last two years. Energy Aspects, a market research company, forecast that Venezuela’s oil production could drop by 200,000 bpd in 2018. Any drop in Venezuela’s production has a positive impact on oil prices.

However, the expectation of a rise in crude oil production from countries like Canada, the US, and Brazil could offset ongoing production cuts, which could pressure oil prices.

Next, we’ll discuss Saudi Arabia’s crude oil production.