How Are Analysts Rating Phillips 66 before Its 1Q17 Earnings?

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating.

April 21 2017, Updated 9:06 a.m. ET

Analyst ratings for Phillips 66

In this series, we’ve looked at Phillips 66’s (PSX) first-quarter estimates, refining margin expectation, and stock performance ahead of its earnings release expected on April 28, 2017. In this part, we’ll see how analysts are rating PSX stock.

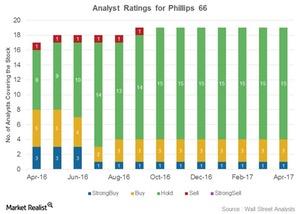

Phillips 66 has been rated by 19 analysts. Of those, four (or 21.0%) have given it a “buy” or “strong buy” rating. Fifteen (or 79.0%) have given it a “hold,” and none have given it a “sell” or “strong sell.” PSX’s mean target price of $88 per share implies a 17.0% rise from its current level. Please refer to Why the Majority of Analysts Rate Phillips 66 as a ‘Hold‘ to know more about why analysts rate PSX a “buy.”

Changes in analyst ratings for Phillips 66

Analyst ratings for Phillips 66 have changed from April 2016 when PSX had one “sell” rating, fewer “hold” ratings, and more “buy” ratings.

In 2017, Phillips 66 stock has seen its target prices cut by various investment banking firms. Recently, Jefferies Group cut PSX’s target price to $74 per share and rated the stock a “hold.” JP Morgan has a “neutral” rating on the stock and lowered the target price to $82 per share from $90 per share. Morgan Stanley has reduced its target price for the stock to $88 from $94.

Peer ratings

Phillips 66’s (PSX) peers Delek US Holdings (DK), HollyFrontier (HFC), and Western Refining (WNR) have been rated a “buy” by 33.0%, 29.0%, and 17.0% of analysts, respectively. Other downstream players such as PBF Energy (PBF) and Alon USA Energy (ALJ) have been rated a “buy” by 35.0% and 11.0% of analysts, respectively.

For exposure to small-cap value stocks, you can consider the iShares Russell 2000 Value (IWN). IWN has a ~5.0% exposure to energy sector stocks, including DK, WNR, and ALJ.