A Look at Allergan’s Performance in 2Q17

Allergan Headquartered in Dublin, Ireland, Allergan (AGN) is a leading pharmaceutical company focused on generic and specialty pharmaceutical products. The company has divided its business into three segments: US Specialized Therapeutics, US General Medicine, and International. Stock price performance Allergan’s stock price has risen ~1.4% in 2Q17, and 15.0% year-to-date as of July 7, 2017. […]

July 11 2017, Updated 7:36 a.m. ET

Allergan

Headquartered in Dublin, Ireland, Allergan (AGN) is a leading pharmaceutical company focused on generic and specialty pharmaceutical products. The company has divided its business into three segments: US Specialized Therapeutics, US General Medicine, and International.

Stock price performance

Allergan’s stock price has risen ~1.4% in 2Q17, and 15.0% year-to-date as of July 7, 2017.

Analysts’ recommendations

Wall Street analysts estimate that the stock has the potential to return ~12.8% over the next 12 months. Analysts’ recommendations show a 12-month targeted price of $272.44 per share, compared with $241.55 per share on July 6, 2017.

Of the 21 analysts tracking Allergan stock, 15 recommend “buy,” and six recommend “hold.” The consensus rating for Allergan stands at 2.1, which represents a “buy” for long-term growth investors.

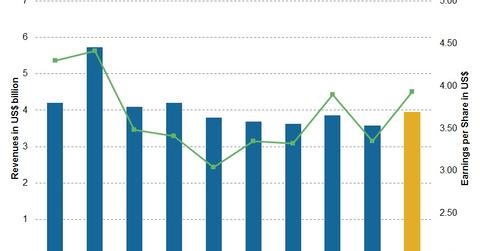

Analysts’ revenue estimates

Allergan’s revenue is mainly driven by the strong performance of Botox, dermal fillers, and Kybella in medical aesthetics, Ozurdex and Restasis in eye care, Linzess and Lo Loestrin in general medicine, and new products Viberzi and Vraylar.

Wall Street analysts expect revenue of $4.0 billion in 2Q17, a ~7% growth from 2Q16, and earnings per share of $3.93. To divest company-specific risk, investors could consider the VanEck Vectors Biotech ETF (BBH), which has a 9.0% exposure to Allergan, a 6.9% exposure to Biogen (BIIB), an 11.4% exposure to Amgen (AMGN), and a 10.6% exposure to Celgene (CELG).