VanEck Vectors Biotech ETF

Latest VanEck Vectors Biotech ETF News and Updates

Allergan’s 1Q18 Earnings: Analysts’ Estimates

Allergan (AGN) plans to release its 1Q18 earnings on April 30. Wall Street expect AGN’s earnings per share to reach $3.36.

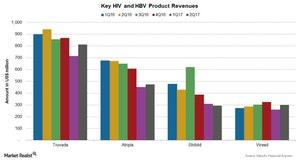

How Gilead’s HIV and HBV Portfolios Performed in 2Q17

Gilead Sciences’ (GILD) portfolio includes various drugs for key therapeutic areas including HIV/AIDS, liver diseases, oncology, cardiovascular, inflammation, respiratory, and others.

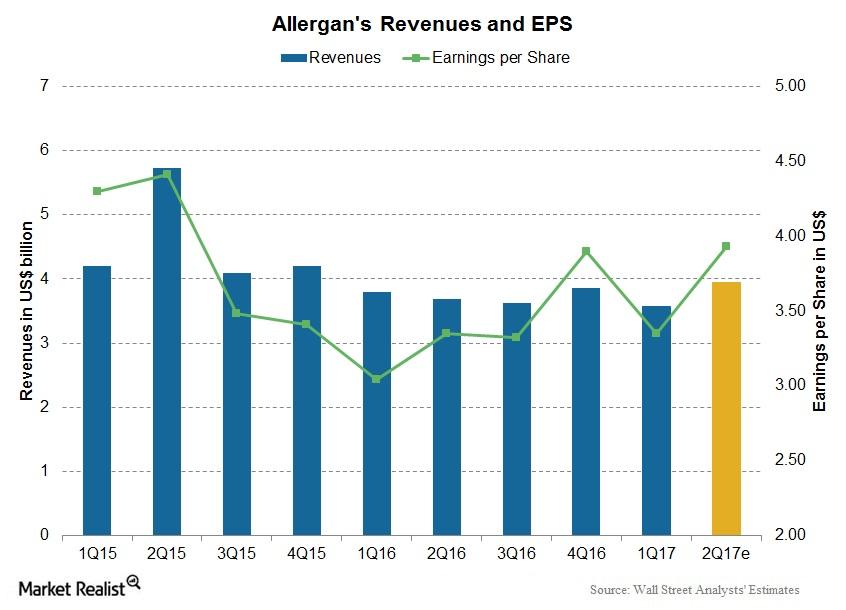

A Look at Allergan’s Performance in 2Q17

Allergan Headquartered in Dublin, Ireland, Allergan (AGN) is a leading pharmaceutical company focused on generic and specialty pharmaceutical products. The company has divided its business into three segments: US Specialized Therapeutics, US General Medicine, and International. Stock price performance Allergan’s stock price has risen ~1.4% in 2Q17, and 15.0% year-to-date as of July 7, 2017. […]

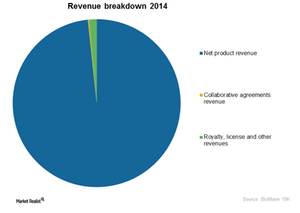

BioMarin’s Business Model and Its 3 Sources of Revenue

Let’s discuss BioMarin’s business model. It derives revenue from three sources, including product revenue. The latter accounts for ~98% of total revenue.