Analyzing Marathon Oil’s 2Q17 Revenues

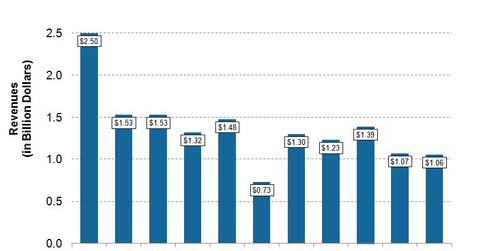

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion.

Aug. 7 2017, Updated 4:05 p.m. ET

2Q17 revenues

For 2Q17, Marathon Oil (MRO) reported revenues of ~$1.06 billion, which was higher than Wall Street analysts’ consensus for revenues of ~$1.02 billion. For 2Q17, MRO reported sales and other operating revenues of ~$958.0 million, marketing revenues of ~$35.0 million, income from equity method investments of ~$51.0 million, a gain on dispositions of ~$6.0 million, and other revenues of ~$9.0 million.

Sequentially, MRO’s 2Q17 revenues are slightly lower than its 1Q17 revenues of ~$1.07 billion. On a year-over-year basis, its 2Q17 revenues were ~18.0% lower than its 2Q16 revenues of ~$1.3 billion.

The year-over-year rise in Marathon Oil’s 2Q17 production and higher realized prices for natural gas (UNG), crude oil (USO), and natural gas liquids impacted MRO’s revenues positively. MRO’s realized price for US liquid hydrocarbons rose to $39 per barrel in 2Q17 compared to $35.07 per barrel in 2Q16. We’ll take a look at MRO’s production in the next part.

How MRO’s quarterly revenues are trending in 2017

For 1Q17, Marathon Oil (MRO) reported revenues of ~$1.1 billion, which was lower than Wall Street analysts’ consensus of ~$1.12 billion. For 1Q17, MRO reported oil and gas production sales revenues of ~$862.0 million and other revenues of ~$210.0 million. That means the majority, or ~80.0%, of MRO’s revenues came from oil and gas production sales. Its other revenues include marketing revenues, equity in earnings of affiliates, and gains on dispositions.

Sequentially, MRO’s 1Q17 revenues are ~23.0% lower compared to 4Q16 revenues of ~$1.4 billion. However, on a year-over-year basis, its 1Q17 revenues are ~46.0% higher compared to 1Q16 revenue of ~$0.73 billion.

Peers

MRO’s peer Encana (ECA) reported revenues of ~$1.1 billion in 2Q17, which was higher than Wall Street analysts’ estimate of ~$783.0 million. The First Trust ISE-Revere Natural Gas ETF (FCG) invests in natural gas producers. The Vanguard Energy ETF (VDE) invests in the broader energy market.

Next, let’s take a look at Marathon Oil’s 2Q17 operational performance.