Can CNX Resources Report Higher Profits in 4Q17?

CNX Resources (CNX) is set to report its 4Q17 and 2017 earnings on February 6, 2018, before the market opens. CNX is expected to report 1,000% higher profits YoY than 4Q16.

Nov. 20 2020, Updated 12:13 p.m. ET

CNX Resources’ 4Q17 net income estimates

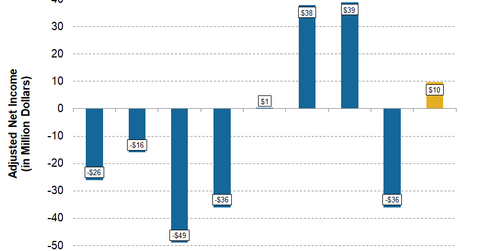

CNX Resources (CNX) is set to report its 4Q17 and 2017 earnings on February 6, 2018, before the market opens. For 4Q17, excluding any one-time items, its current consensus net income estimate is $10 million. On a year-over-year basis, CNX is expected to report 1,000% higher profits than its 4Q16 adjusted net income of just $1 million. Even on a sequential basis and excluding any one-time items, CNX’s 4Q17 consensus net income estimate is much higher from a loss of $36 million in 3Q17.

Thus, based on the current consensus net income estimate, CNX is expected to report a higher profit. Below, we’ll look at CNX’s 4Q17 EPS (earnings per share) estimate. CNX’s peer Southwestern Energy (SWN), which is also the part of the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), expects a higher profit of $67 million in 4Q17, from $39 million in 4Q16. Like CNX, SWN has operations in the Marcellus Shale.

CNX Resources’ 4Q17 EPS estimates

For 4Q17, excluding any one-time items, Wall Street analysts’ current consensus EPS estimate for CNX is $0.02. On a year-over-year basis, its 4Q17 current consensus EPS estimate is higher by $0.02 than its 4Q16 adjusted EPS of $0.00. Sequentially, CNX’s 4Q17 current consensus EPS estimate is higher than -$0.15 in 3Q17.

CNX Resources’ 2017 estimates

For 2017, excluding any one-time items, Wall Street analysts expect CNX Resources to report adjusted net income of -$13 million, or $0.00 per share, from -$101 million, or -$0.43 per share, in 2016.

In 2017, CNX was among the negative performing upstream companies with a -4% return. It widely underperformed the SPDR S&P 500 ETF (SPY) and the SPDR Dow Jones Industrial Average ETF (DIA), which rose 19% and 25%, respectively, in the year. To know more about the best and worst upstream stock performers in 2017, check out Market Realist’s series The Best and Worst Upstream Companies by Year-to-Date Returns.

In this series

Having analyzed CNX’s 4Q17 earnings expectations, we’ll look in the rest of the series at CNX’s revenues expectations, production guidance, cash flow estimates, and the odds of CNX beating its EPS expectations.