Pfizer’s Segment Performance in 1Q17

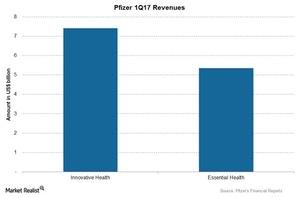

Pfizer Innovative Health contributed $7.4 billion, or about 58.0% of Pfizer’s total revenues in 1Q17.

June 28 2017, Updated 7:36 a.m. ET

Pfizer’s business

Pfizer (PFE) is a multinational pharmaceutical leader in medicines, vaccines, and consumer healthcare products. Pfizer’s business is divided into two business segments: Innovative Health and Essential Health.

Innovative Health, previously Innovative Pharmaceutical, includes vaccines, oncology products, and consumer healthcare products.

Essential Health, previously Established Pharmaceutical, includes established pharmaceuticals and legacy Hospira products that Pfizer acquired in 2015.

Segment performance

Let’s look now at the performances of these two segments in 1Q17.

The Innovative Health segment contributed $7.4 billion, or about 58.0% of Pfizer’s total revenues. The segment’s revenues rose 6.0% operationally to $7.4 billion in 1Q17, mainly driven by revenue growth for Eliquis, Ibrance, Lyrica, Xeljanz, Xtandi, new products, and alliance revenues.

The Essential Health segment contributed $5.4 billion, or nearly 42.0% of Pfizer’s total revenues. The segment’s revenues fell 9.0% operationally to $5.4 billion in 1Q17, mainly driven by lower sales of Peri-LOE and legacy established products, partially offset by the rise in revenues from legacy Hospira products.

If we exclude Hospira product revenues, then Essential Health revenues fell 6.0% operationally to $5.3 billion in 1Q17.

To divest the company-specific risks, you can consider the iShares Core High Dividend (HDV), which holds ~4.9% of its total assets in Pfizer. HDV also holds 3.5% in Merck & Co. (MRK), 1.5% in Eli Lilly (LLY), and 5.8% in Johnson & Johnson (JNJ).