Will US Crude Oil Production Undermine Crude Oil Futures?

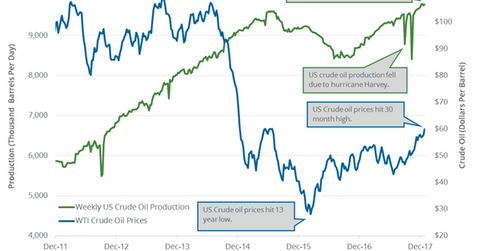

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017.

Oct. 9 2019, Updated 9:20 p.m. ET

Weekly US crude oil production

According to the EIA, US crude oil production increased by 28,000 bpd (barrels per day) to 9,782,000 bpd on December 22–29, 2017. Production increased 0.3% week-over-week and by 1,012,000 bpd or 11.5% from a year ago. The EIA released US crude oil production data on January 4, 2018. Crude oil (UWT) (USO) prices rose on January 4, 2018, due to the bullish drivers that we discussed in Part 1 of this series.

US crude oil production

US crude oil production tested 8,428,000 bpd for the week ending July 1, 2016—the lowest production level in nearly three years. Production has increased by 1,354,000 bpd or 16.1% since July 1, 2016. Higher oil (SCO) prices in 2017 and improving drilling costs supported the rise in US oil production.

Estimates for 2018

US oil production averaged 9.2 MMbpd (million barrels per day) in 2017, according to the EIA. Production could average ~10,020,000 bpd in 2018. It would be the highest annual production average ever.

Higher oil prices could contribute to higher oil rigs and supplies in 2018. It also benefits oil producers (FXN) (IYE) like PDC Energy (PDCE), Denbury Resources (DNR), and Stone Energy (SGY).

Production cuts and US oil production

OPEC and Russia extended the production cuts until December 2018. US oil production rose by 836,000 bpd or 9.3% on January 6–December 29, 2017. It has offset ~46.4% of the production cuts.

Impact

The rise in US crude oil production is the biggest threat to oil prices in 2018. The rise in non-OPEC supplies could also pressure oil (UCO) prices.

Next, we’ll discuss another bearish driver for crude oil in 2018.