What’s the 3-Year Correlation between Miners and Gold?

Gold is the most influential precious metal, and most miners follow its price trends.

Jan. 10 2018, Updated 8:38 a.m. ET

Miners’ correlation with gold

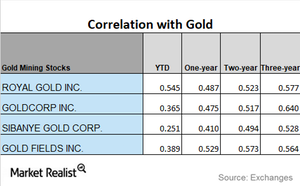

Gold is the most influential precious metal, and most miners follow its price trends. For our correlation analysis, we are comparing the mining stocks to gold. In this part of the series, we’ll look at Royal Gold (RGLD), Goldcorp (GG), New Gold (NGD), and Newmont Mining (NEM). We’ll look at the performance of the miners and their correlation to gold over the past three years.

The past week was beneficial for precious metals and mining stocks like the VanEck Vectors Junior Gold Miners Fund (GDXJ) and the Global X Silver Miners (SIL). They have risen 1.5% each on a five-day trailing basis. The mining-based funds also depict a considerable correlation to gold.

Downward trend

Among the four miners that we are discussing, Royal Gold, Goldcorp, and New Gold have seen their correlation to gold drop during the past three years. New Gold saw its three-year correlation drop from 0.54 to a one-year correlation of 0.25. A correlation of 0.25 suggests that during the past one year, New Gold moved in the same direction as gold about 25% of the time.

However, the correlation tends to change over time. An understanding of how mining stocks correlate to gold is essential, as it provides insight into the future price movement of these miners.