A Look at Bank of America’s Key Growth Drivers

Bank of America’s dividend yield of 1.5% and PE of 20.6x compares to a sector average dividend yield of 2% and PE of 20.7x.

Jan. 26 2018, Published 11:08 a.m. ET

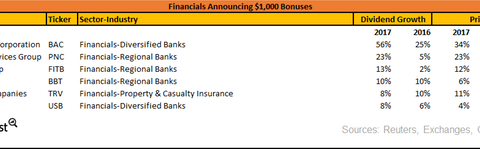

Financials sector

This series will focus on financial sector stocks that have announced $1,000 bonuses. We’ll start with Bank of America (BAC).

What drove revenue?

Bank of America’s revenue net of interest expense grew 1% and 4% in 2016 and 2017, respectively. Net interest income grew 5% and 9% in 2016 and 2017, respectively, while noninterest income fell 3% in 2016 and remained flat in 2017.

What drove the diluted EPS growth?

Noninterest expense decreased 5% in 2016 and remained flat in 2017. As a result, income before income taxes grew 14% and 13% in 2016 and 2017, respectively. Diluted EPS grew 14% and 5% in 2016 and 2017, respectively. Share buybacks have further enhanced the EPS numbers.

How did the dividend yield and price perform?

The company has an impressive free cash flow position. The company’s dividend yield fell in 2016 before increasing again in 2017. The increase is due to the higher dividend growth rate and uniform price gains in 2017.

Bank of America’s dividend yield of 1.5% and PE of 20.6x compares to a sector average dividend yield of 2% and a PE of 20.7x. Prices rose 31%, 34%, and 8% in 2016, 2017, and on a YTD basis, respectively.

Company versus the broad indexes

The S&P 500 (SPX-INDEX) (SPY) offers a dividend yield of 2.2% and a PE ratio of 24.6x. Prices rose 10%, 19%, and 5% in 2016, 2017, and on a YTD basis, respectively.

The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.1% and a PE ratio of 24.9x. Prices gained 13%, 25%, and 5% in 2016, 2017, and on a YTD basis, respectively.

The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 25.4x. Prices rose 8%, 28%, and 6% in 2016, 2017, and on a YTD basis, respectively.

Going forward

During 2017, the company witnessed an increase in the prime lending rate as the Fed hiked rates three times. The company is looking forward to the potential deregulation of Dodd-Frank and Fed rate hikes in 2018.