US Oil Exports Are Crucial for Oil Prices in 2018

On January 8, 2018, Brent crude oil (BNO) active futures were $6.05 stronger than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures.

Jan. 10 2018, Updated 7:36 a.m. ET

Brent-WTI spread

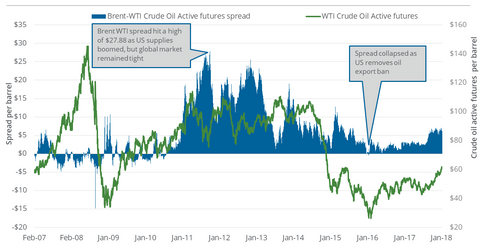

On January 8, 2018, Brent crude oil (BNO) active futures were $6.05 stronger than WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures. On December 29, 2017, this difference or the “Brent-WTI spread” was $6.45. Between these two dates, Brent crude oil futures rose 1.4% and WTI crude oil prices rose 2.2%.

US oil exports

US crude oil exports were at ~1.47 MMbpd (million barrels per day) for the week ending December 29, 2017—0.3 MMbpd higher than the previous week. In 2017, US crude oil exports doubled from 2016 on average—based on weekly data. The Brent-WTI spread more than doubled during this period. A rise in US crude oil exports in 2018 due to the high Brent-WTI spread might pressure international oil prices and the spread could narrow.

If the price difference between Brent and US crude oil rises due to other factors like international supply outages, then it could provide a boost for US oil exporters.

If the spread expands, it could harm US oil producers’ (XOP) (DRIP) revenue in the domestic market compared to their international peers’ revenue. Crude oil produced in the US usually follows US crude oil prices, while oil produced by international peers follows Brent oil prices.

US refineries’ (CRAK) output prices are benchmarked to Brent oil prices. By increasing the intake of WTI crude oil in their refineries, they could widen their profit margins.