Why the US Dollar Began 2018 with Losses

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies.

Jan. 10 2018, Published 12:15 p.m. ET

Why the US dollar continued its bad run

The US Dollar index (UUP) began 2018 on a negative note, posting losses against most of the major currencies. The US employment report indicated that 148,000 jobs were added in December 2017. That’s lower than the consensus estimate of 190,000. The other factor impacting the US dollar was the narrowing spread in the US Treasury market, which has moved closer to pre-recession levels of 2007–2008. The US dollar index closed the week ended January 5, 2018, at 91.67, depreciating 0.17%.

Speculators reduced bearish positions

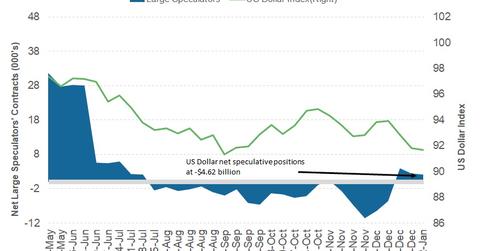

According to the latest COT (Commitment of Traders) Report released on January 5, 2018, by the CFTC (Chicago Futures Trading Commission), large speculators increased their bearish plays on the US dollar.

According to Reuters’ calculations, the net US dollar (USDU) net short positions increased from -$2.2 billion to -$4.6 billion last week. That amount is a combination of US dollar contracts against the combined contracts for the euro (FXE), the British pound (FXB), the Japanese yen (FXY), the Australian dollar (FXA), the Canadian dollar (FXC), and the Swiss franc.

Outlook for the US dollar

December 2017 inflation, retail sales, and Fed speeches could be the key drivers for the US dollar. Expectations remain flat for inflation growth, while retail sales are expected to have improved in December. Finally, if Fed members continue to support aggressive rate hikes, the US dollar could remain supported at the current levels. Any doubts about inflation growth in Fed member speeches could exert further pressure on the US dollar this week.

In the next part of this series, we’ll see how the bond markets performed in the first week of 2018.