Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.

Jan. 25 2018, Published 1:02 p.m. ET

A sneak peek at the list

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months. We’ll look at consumer (WMT) (CMCSA), telecommunications (T) (SBGI), and airline companies (LUV) (ALK) (AAL) (JBLU). Part 2 of this series will include the financials.

The above chart shows the companies that have announced $1,000 bonuses. All those companies, except Sinclair Broadcast Group (SBGI) and JetBlue Airways (JBLU), are in the S&P 500. In the list below, financials followed by industrials have dominated, followed by the telecommunications and consumer sectors.

Sector performance of the list

The telecommunications (or telecom) sector has recorded the highest dividend yield, followed by consumer staples. Telecom had a great 2017 driven by smartphone sales and other devices. However, telecom companies, including AT&T (T), have been hit by the tariff war from smaller companies. Consumer staples form the necessities of life, and an improvement in the global economic scenario is driving the demand for the airline industry. Low fares have supported this further due to low fuel prices. The performance of financials has been in anticipation of the dismantling of the Dodd-Frank regulations and changes in the federal tax code. The Federal Reserve’s three interest rate hikes in 2017 were followed by hikes in prime lending rates by companies in the financial sector.

Tax reform and improving economic fundamentals could trigger more rate hikes by the Fed in 2018. That could be in anticipation of higher inflation rates and oil prices.

List versus the broader indexes

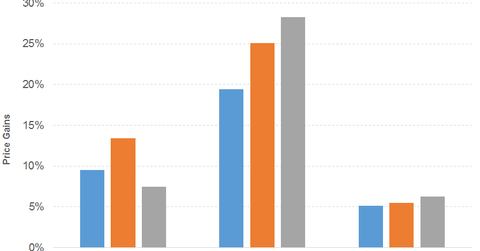

The S&P 500 (SPX-INDEX) (SPY) offers a dividend yield of 2.2% and a PE (price-to-earnings) ratio of 24.6x. It rose 10%, 19%, and 5% in 2016, 2017, and YTD (year-to-date), respectively.

The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.1% and a PE ratio of 24.9x. It rose 13%, 25%, and 5% in 2016, 2017, and YTD, respectively.

The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 25.4x. It rose 8%, 28%, and 6% in 2016, 2017, and YTD, respectively.

Sector ETFs

The Consumer Staples Select Sector SPDR ETF (XLP) has a PE ratio of 20.7x and a dividend yield of 2.6%. The Consumer Discretionary Select Sector SPDR ETF (XLY) has a PE ratio of 20.5x and a dividend yield of 1.1%. The Vanguard Telecommunication Services ETF (VOX) has a PE ratio of -8.8x and a dividend yield of 3.9%. The US Global Jets ETF (JETS) has a PE ratio of 11.6x and a dividend yield of 0.4%.