Sinclair Broadcast Group Inc

Latest Sinclair Broadcast Group Inc News and Updates

When Can Disney Resume Its Share Buyback Program?

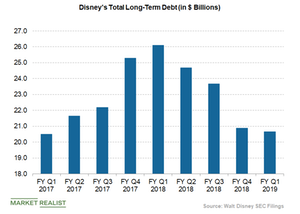

Disney has suspended its share repurchase program temporarily due to its heavy debt load.

Which Stocks Have Announced $1,000 Bonuses?

In this series, we’ll be taking a look at the companies that have announced $1,000 dollar bonuses, pay raises, increased dividends, and buybacks in the last two months.