Johnson & Johnson’s Pharmaceuticals Business in 4Q17

Johnson & Johnson (JNJ) reported ~48.0% of its total revenues from the Pharmaceuticals business during 4Q17, making it the company’s largest revenue contributor.

Jan. 31 2018, Updated 7:34 a.m. ET

Pharmaceuticals business

Johnson & Johnson (JNJ) reported ~48.0% of its total revenues from the Pharmaceuticals business during 4Q17, making it the company’s largest revenue contributor.

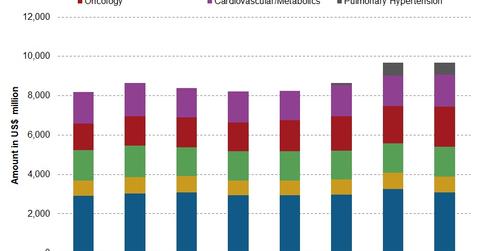

JNJ’s Pharmaceuticals business includes revenues from the following franchises: oncology, cardiovascular and metabolics, infectious disease, immunology, neuroscience, and pulmonary hypertension. The chart below compares the revenues for the various franchises for the Pharmaceuticals segment since 1Q16.

Immunology franchise

Johnson & Johnson’s (JNJ) immunology franchise reported 5.1% growth in revenues to ~$3.1 billion during 4Q17, compared to ~$2.9 billion during 4Q16.

The franchise’s increase in revenues was driven by ~23.0% growth in Stelara sales and ~15.0% growth in Simponi/Simponi Aria sales. Its revenues were partially offset by a 9.7% decline in Remicade revenues.

Infectious disease franchise

JNJ’s infectious disease franchise reported 5.1% growth in revenues to $800.0 million during 4Q17, compared to $761.0 million in 4Q16. This increase in revenues was driven by ~16.4% growth in Edurant sales and ~5.1% growth in Prezista/Prezcobix sales. The revenue increase was partially offset by the decline in sales of other products.

Neuroscience franchise

JNJ’s neuroscience franchise reported 3.7% growth in revenues to $1.52 billion during 4Q17, compared to $1.47 billion during 4Q16. The increase in revenues was driven by ~18.5% growth in Invega Sustenna sales. This increase was substantially offset by lower sales of Concerta, Risperdal Consta, and other neuroscience products.

Oncology franchise

Johnson & Johnson’s oncology franchise reported 39.5% growth in revenues to ~$2.0 billion during 4Q17 compared to ~$1.5 billion during 4Q16. This increase in revenues was driven by ~85.5% growth in Darzalex sales, ~50.9% growth in Imbruvica sales, and ~45.5% growth in Zytiga sales. This revenue increase was partially offset by lower sales of other products.

Cardiovascular and metabolics products

Johnson & Johnson’s cardiovascular and metabolics franchise reported 1.2% growth in revenues to $1.62 billion during 4Q17 compared to $1.60 billion during 4Q16. This increase in revenues was driven by ~18.7% growth in Xarelto sales and ~10.1% growth in the sales of other products. The increase was substantially offset by lower sales of Procrit and Invokana.

Pulmonary hypertension products

Johnson & Johnson’s (JNJ) total revenues from pulmonary hypertension products totaled $610.0 million during 4Q17. This franchise’s products include Opsumit, Tracleer, and Uptravi. The franchise was acquired from Actelion in 2Q17.

The SPDR S&P Pharmaceuticals ETF (XPH) holds 4.1% of its total investments in Johnson & Johnson (JNJ), 4.5% in Merck & Co. (MRK), 4.1% in Bristol-Myers Squibb (BMY), and 4.2% in Pfizer (PFE).