Is the Leading Credit Index Signaling Any Business Cycle Changes?

This constituent of the LEI is an economic model, constructed by modeling changes in six financial market instruments.

Feb. 1 2018, Updated 9:03 a.m. ET

The Leading Credit Index

The Conference Board has an interesting constituent in its LEI (Leading Economic Index) that is published every month and tracks the credit conditions in the US economy. This constituent of the LEI is an economic model, constructed by modeling changes in six financial market instruments.

These six components of the LCI (Leading Credit Index) track the lending conditions in the economy:

- two-year swap (SHY) spread (real time)

- LIBOR three-month (SCHO) less three-month Treasury-bill (VGSH) yield spread (real time)

- debit balances at margin account at broker-dealer (monthly)

- AAII investor sentiment: bullish (%) less bearish (%) (weekly)

- senior loan officers C&I loan survey: bank tightening credit to large (SPY) and medium firms (IWM) (quarterly)

- security repurchases (GOVT) (quarterly) from the Total Finance-Liabilities section of Federal Reserve’s flow of fund report

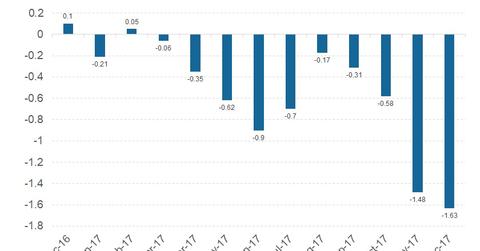

Performance of the LCI in December

The LCI for December was reported at -1.63—its best level in a decade, and an improvement from November’s reading of -1.48. The LCI is an inverted series, wherein a negative change in value has a positive contribution to the LEI.

This credit index has a weight of 8.2% on the LEI and in the January report, the LCI had a net positive impact of 0.13 (or 13%) on the overall improvement in the LEI.

Credit conditions continued to improve

Most businesses run on credit, and the availability of credit plays a vital role in economic improvement. Since the onset of the financial crisis, leading rates and the availability of credit have dwindled, forcing the Fed to lower interest rates to nearly 0% and to flush the system with liquidity using extraordinary monetary policy measures.

These steps have helped provide abundant liquidity and access to funding, helping the economy out of a recession. Notably, the proposed reduction of banking regulations could further improve credit conditions in the US, paving way for further gains in the LCI in 2018.

In the next part of this series, we’ll discuss the continued flattening of the yield curve.