Is Oil Set to Make Record Highs in 2018?

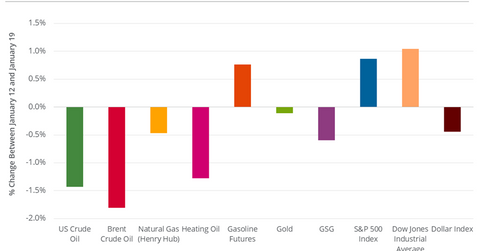

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%.

Nov. 20 2020, Updated 11:28 a.m. ET

US crude oil

Between January 12 and January 19, 2018, US crude oil (USO) (USL) March futures fell 1.4%. A rise in US crude oil production for the week ended January 12, 2018, could be behind this fall. On January 19, 2018, US crude oil March futures were ~1.5% below US crude oil active futures’ three-year high and settled at $63.31 per barrel.

The IEA (International Energy Agency) released its Oil Market Report on January 19, 2018. Its demand growth estimate for 2018 was at 1.3 million barrels per day, the same as the previous estimate. Moreover, the IEA estimates that between 2Q18 and 4Q18, oil demand will overtake oil supply based on the report, a bullish factor for oil prices, which could push oil prices to record highs in 2018.

US crude oil futures near their three-year highs would likely benefit the energy holdings of the S&P 500 Index (SPY) (SPX-INDEX) and the Dow Jones Industrial Average Index (DIJA-INDEX). In part two, we’ll discuss the returns of these equity indexes.

Natural gas

Between January 12 and January 19, 2018, natural gas’s (UNG) (BOIL) February futures fell just 0.5%. On January 19, natural gas futures settled at $3.19 per MMBtu (million British thermal unit). A less-than-expected fall in natural gas inventories had driven prices lower in the last week.