Eurozone Manufacturing Activity Reaches a High in December 2017

Eurozone manufacturing activity in December According to Markit Economics, the Eurozone’s manufacturing PMI (purchasing managers’ index) rose strongly in December 2017, to 60.6 from 60.1 in November 2017. It beat the market expectation of 60.4 and marked the strongest expansion in manufacturing activity since 1997. Major Eurozone members Germany (EWG) (DAX-INDEX), France (EWQ), Spain (EWP), and Italy […]

Jan. 11 2018, Updated 2:50 p.m. ET

Eurozone manufacturing activity in December

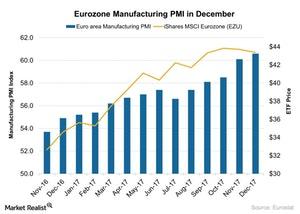

According to Markit Economics, the Eurozone’s manufacturing PMI (purchasing managers’ index) rose strongly in December 2017, to 60.6 from 60.1 in November 2017. It beat the market expectation of 60.4 and marked the strongest expansion in manufacturing activity since 1997.

Major Eurozone members Germany (EWG) (DAX-INDEX), France (EWQ), Spain (EWP), and Italy posted a strong rise in manufacturing activity in December 2017. Germany’s manufacturing PMI reached a multidecade high of 63.3 in December 2017. The Eurozone’s manufacturing PMI’s strong performance in December was mainly due to the following:

- production volume and output rose at a faster rate

- new business and export orders grew at a solid rate

- employment in the manufacturing sector rose at a faster rate

Impact on the economy

The Eurozone’s gradual and strong rise in manufacturing and service activity suggest that its economy is strengthening, which may be boosting investors’ confidence in European businesses. The iShares MSCI Eurozone ETF (EZU), which tracks the Eurozone’s (HEDJ) (FEZ) (IEV) economic performance, fell 0.3% in December 2017. However, the Vanguard FTSE Europe ETF (VGK) rose 1%. In the next part of this series, we’ll look at Japan’s manufacturing PMI in December 2017.