Does Natural Gas’s Rise Depend on Crude Oil?

Between January 16 and January 23, 2018, natural gas (GASL) (UNG) (FCG) had a correlation of 84.6% with US crude oil (OIIL) (USL) (DBO) active futures.

Jan. 25 2018, Updated 9:40 a.m. ET

Correlations

Between January 16 and January 23, 2018, natural gas (GASL) (UNG) (FCG) had a correlation of 84.6% with US crude oil (OIIL) (USL) (DBO) active futures. In this period, US crude oil rose 1.3%, and natural gas futures spiked 10.1%.

On January 23, 2018, US crude oil active futures were at their new highest closing level of $64.47 per barrel in the last three years. The Saudi Arabian oil minister’s comment in support of extending the OPEC production cut after 2018 could be behind the rise in oil prices. The forecast of lower temperatures discussed in part one had boosted natural gas prices. The high demand for heating oil during low temperatures could also support oil prices.

Last month’s correlation

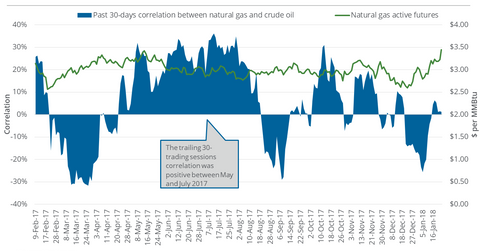

On January 23, 2018, natural gas and US crude oil’s correlation during the last 30 trading sessions was just 1.3%. However, natural gas futures rose 24.6% and US crude oil futures rose 17.9% over this time period.

Nevertheless, this correlation was positive and persistently above 30% during May and July 2017, which indicates a possible sustained positive relationship between the two energy commodities.

Of course, the prices of these commodities also depend on individual fundamental factors. For example, natural gas prices are more impacted by winter demand than any other factor at this time of the year.