Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

Jan. 12 2018, Updated 10:33 a.m. ET

What led to Assurant’s revenue decline?

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively. Net earned premiums and net investment income drove the decline in 2016 offset by fees and other income. Net realized gains on investments, amortization of deferred gains, gains on disposal of businesses, and a gain on pension plan curtailment boosted the company’s 2016 revenue. Both the US and international segments contributed to the decline. Every segment mentioned above contributed to the decline in 9M17.

How much did the EPS fall?

Benefits, losses, and expenses decreased 34% and 11% in 2016 and 9M17, respectively. As a result, income from continuing operations grew 322% in 2016 before falling 64% in 9M17. Adjusted income from continuing operations fell 43% in 2016 and gained 5% in 9M17. Adjusted net income fell 39% in 2016 and 52% in 9M17. Diluted EPS dropped 32% and 47% in 2016 and 9M17, respectively. Share buybacks have enhanced the EPS numbers.

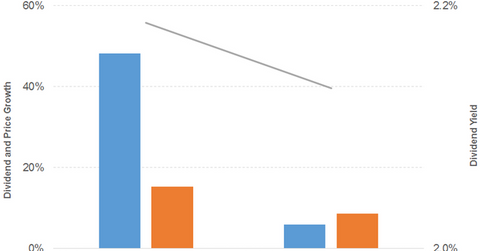

Dividend and price growth?

Dividend per share grew 48% and 6% in 2016 and 2017, respectively. Prices gained 15% and 9% in 2016 and 2017, respectively, which led to a downward sloping dividend yield curve. A forward PE of 26.5x and a dividend yield of 2.2% compares to a sector average forward PE of 19.1x and a dividend yield of 1.9%.

How does it compare to the broad indexes?

The S&P 500 (SPX-INDEX) (SPY) has a dividend yield of 2.2%, a PE ratio of 23.4x, and a YTD return of 19.6%. The Dow Jones Industrial Average (DJIA-INDEX) (DIA) has a dividend yield of 2.2%, a PE ratio of 22.3x, and a YTD return of 25.1%. The NASDAQ Composite (COMP-INDEX) (ONEQ) has a PE ratio of 28.2x and a YTD return of 24.8%.

What is the revenue and EPS outlook?

Assurant is projected to record a revenue decline of 16% in 2017 before gaining 6% in 2018. The 2018 diluted EPS is expected to fall by 17% in 2017 before gaining 110% in 2018.