Assurant Inc

Latest Assurant Inc News and Updates

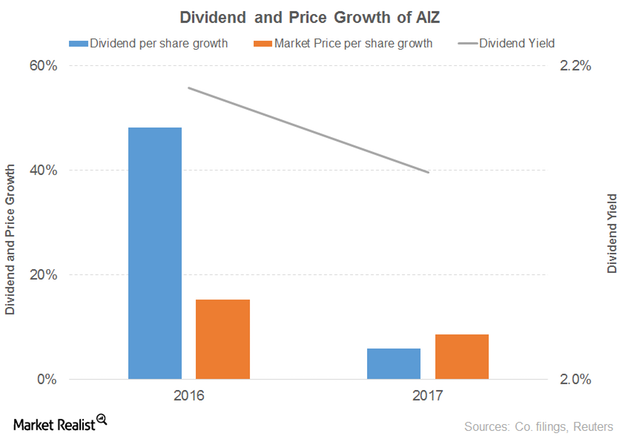

Why Assurant Has a Positive Outlook despite a Weak 2017

Assurant’s (AIZ) revenue fell 27% and 18% in 2016 and 9M17, respectively.

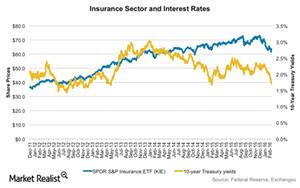

The Effect of an Interest Rate Reversal on Insurance Companies

Interest rates are a key performance driver for life insurance companies. They affect their margins, hedging costs, and product sales.