Analyzing Euronav’s Balance Sheet on December 31

Euronav had a liquidity of $754 million at the end of the fourth quarter. Euronav has been working to strengthen its liquidity position.

Feb. 2 2018, Updated 7:35 a.m. ET

Leverage

Managing finances, especially for highly leveraged companies, is very important. Euronav (EURN), just like other crude oil tanker companies, is highly leveraged.

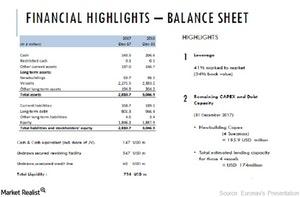

Euronav has already paid $63.7 million to HHI related to the construction of four Suezmax vessels. The vessels are supposed to be delivered during 2018. The remaining capex for these vessels is $185.9 million. Euronav will borrow $173.5 million under a new facility.

Debt profile

As of December 31, 2017, Euronav had total bank loans of $701 million—$653 million was a long-term loan and the remainder was a short-term loan. The long-term loan was ~$966 million as of December 31, 2016. Since 2010, Euronav’s debt has been below $1.2 billion. Euronav’s leverage was 34% of the book value and 41% of the market value.

Liquidity position

Euronav had a liquidity of $754 million at the end of the fourth quarter. Euronav has been working to strengthen its liquidity position.

Euronav’s current assets of $280 million are well above its current liabilities of $158 million. Its current ratio is ~1.77x—compared to ~1.29x at the end of the previous quarter. Nordic American Tankers (NAT) has the highest current ratio among its peers. At the end of 3Q17, Nordic American Tankers’ ratio was 3.52x. The ratios for Teekay Tankers (TNK), DHT Holdings (DHT), and Tsakos Energy Navigation (TNP) as of December 31, 2017, were 0.67x, 1.65x, and 1.03x, respectively.