Is It Worth Risking Long Trades in Oil?

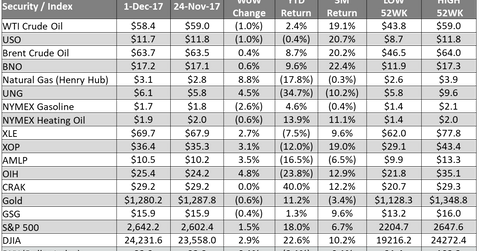

On November 24–December 1, 2017, US crude oil (USO) (USL) January futures fell 1%. On December 1, US crude oil January futures closed at $58.36 per barrel.

Nov. 20 2020, Updated 1:57 p.m. ET

US crude oil

On November 24–December 1, 2017, US crude oil (USO) (USL) January futures fell 1%. On December 1, 2017, US crude oil January futures closed at $58.36 per barrel.

In the week ending December 1, 2017, the US oil rig count rose by two to 749. The rise was small, but the count increased for two consecutive weeks. The rise in the oil rig count could push US crude oil production to a new record. It could add more downside to oil prices. Higher US crude oil exports could also limit the upside in international oil prices.

OPEC’s output cut extension was at par with market expectations and it has already been discounted in oil prices. So, traders should stay cautious of their long bets on oil prices.

Natural gas

On November 24–December 1, natural gas January 2018 futures rose 5%. On December 1, 2017, natural gas January futures closed at $3.061 per MMBtu. Lately, the fall in the natural gas inventory level could have supported natural gas prices.

On November 24–December 1, 2017, the S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA) rose 1.5% and 2.9%. In the next part, we’ll discuss a few more equity indexes.