Will the EIA Upgrade US Crude Oil Production Estimates?

Weekly US crude oil production hit 9,707,000 bpd for the week ending December 1, 2017—the highest level ever.

Dec. 12 2017, Published 8:06 a.m. ET

API’s crude oil inventories

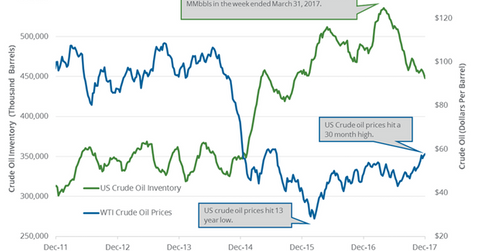

The API (American Petroleum Institute) will publish its crude oil inventory report on December 12, 2017. Market surveys estimated that US crude oil inventories could have fallen by 3,780,000 barrels on December 1–8, 2017.

On December 13, 2017, the EIA will release its weekly crude oil inventory report. A massive fall in US oil inventories is bullish for oil (OIL) (USO) prices. However, any massive rise in gasoline inventories could pressure gasoline and oil (UWT) (DWT) prices.

The crude oil inventories at Cushing, Oklahoma, would have fallen by 2,500,000 barrels on December 1–8, 2017, according to Bloomberg. Any fall in Cushing inventories is bullish for oil (DBO) (USL) prices. Higher oil prices benefit oil producers’ (IYE) (IXC) earnings like Denbury Resources (DNR), Anadarko Petroleum (APC), Contango Oil & Gas (MCF), and Cobalt International Energy (CIE).

US crude oil production

Weekly US crude oil production hit 9,707,000 bpd for the week ending December 1, 2017—the highest level ever. The EIA will publish its monthly STEO (Short-Term Energy Outlook) report on December 12, 2017. In the previous report, it estimated that US crude oil production would average 9,950,000 bpd in 2018—the highest annual average ever.

If the EIA upgrades US crude oil production data for 2018, it would pressure oil prices. Higher oil prices and improving drilling costs would drive US production.

Impact

Tradition Energy estimates that US crude oil production could hit 10,000,000 bpd in the next three to six months. High US oil production could also offset some of the benefits of current production cuts. Any rise in US oil production is bearish for oil (DWT) prices.

Next, we’ll discuss Iraq’s crude oil production and its impact on the global oil market.