Why Valuation Multiples for Royalty and Streaming Companies Have Risen in 2017

Royalty and streaming mining companies (RING) (SIL) have business models that are considered quite conservative because they don’t own mines.

Nov. 20 2020, Updated 3:07 p.m. ET

Royalty and streaming companies

Royalty and streaming mining companies (RING) (SIL) have business models that are considered quite conservative because they don’t own mines. In fact, they have somewhat fixed income streams after making upfront payments for production rights to mines.

This could be why this group of miners has seen higher valuation multiples than miners in other categories. All the royalty companies have seen significant rises in their valuation multiples on a YTD (year-to-date) basis.

FNV has the highest multiple

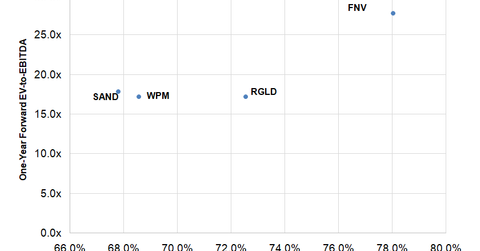

Among the four major streaming companies we’ll be discussing in this part of our series, Franco-Nevada (FNV) has the highest forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 27.1x. This implies a premium of 38.5% to its peers, and the premium seems justified, given FNV’s superior growth profile, strong balance sheet, and diversified production base.

Wheaton Precious Metals (WPM), which was previously known as Silver Wheaton (SLW), has a multiple of 17.2x, which is similar to Royal Gold’s (RGLD) multiple. These two companies’ stock multiples have seen increases of 27.4% and 30.5%, respectively, YTD.

WPM’s discount to Franco-Nevada is primarily due to WPM’s lower production growth profile. Some of its streams are also facing issues.

Re-rating catalysts

RGLD has significantly diversified in the past one to two years. Another accretive acquisition could provide a further catalyst for the stock going forward. Until then, its valuation could be more or less full.

Lastly, Sandstorm Gold (SAND) is a smaller company than its peers. It has a forward multiple of 17.9x, reflecting an increment of 45% YTD. Its strong multiple expansion is likely due to positive updates, including robust exploration and drilling results. The company has also repurchased 3.3 million shares since July 2017.