How Eager Are Precious Metals to Hear the Fed’s Decision?

Gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision.

Dec. 13 2017, Published 11:58 a.m. ET

FOMC meeting outcome awaited

Among the four precious metals, gold, silver, and platinum all had a down day on Tuesday, December 13, mainly due to speculations over the Federal Reserve’s pending interest rate decision. Investors are closely watching the outcome of the next FOMC (Federal Open Market Committee) meeting.

Market participants are anticipating that the interest rate in the US will now increase at the fastest pace in more than a decade, and a higher rate of interest is negative for precious metals because they are non-yield paying assets. A higher interest rate offered on Treasuries drives investors to these yield-bearing assets, and they wind up discarding precious metals, which provide no intermediary cash flows.

Interest rate hiked

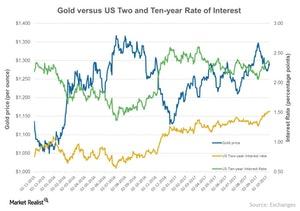

The chart above compares the performance of gold with the US two- and ten-year rate of interest (SHY) (IEF). If the Fed decides to hike the rate again this month, longer- and shorter-term yields would likely react positively. The gold- and silver-based funds that have already reacted negatively to a possible hike include the iShares Gold Trust (IAU) and the iShares Silver Trust (SLV), which have fallen 2.4% and 4.2%, respectively, on a 30-day trailing basis.

The US dollar rose 0.25% on Tuesday due to the possibility of another rate hike this month. A higher dollar and higher interest rates are both negative for precious metals as well as for their mining shares. The miners that dropped on Tuesday include Agnico Eagle Mine (AEM), Franco-Nevada (FNV), Yamana Gold (AUY), and Pan American Silver (PAAS), which fell 1.3%, 1.1%, 1.2%, and 0.48%, respectively.