How Newmont Mining Plans to Generate Free Cash Flow in 2018

As NEM’s all-in sustaining costs (or AISC) have fallen 22.0% since 2012, its FCF has improved by $3.60 per share.

Dec. 22 2017, Updated 10:31 a.m. ET

FCF generation-A priority

Generating FCF (free cash flow) is an important factor for miners (GDX)(RING), as it helps them optimize their financial leverages, invest in projects supporting long-term value, and provide shareholder returns.

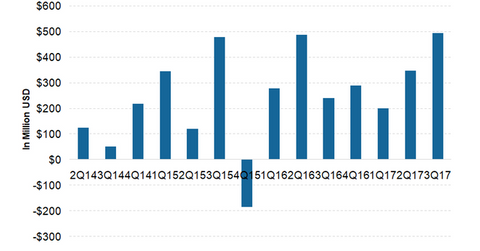

Newmont Mining (NEM) has improved its free cash flow (or FCF) generation significantly along with reducing its costs in the last few years. As NEM’s all-in sustaining costs (or AISC) have fallen 22.0% since 2012, its FCF has improved by $3.60 per share. It has generated ~$2.5 billion since 2013.

FCF generation second-half-weighted in 2018

In the first nine months of the year, Newmont Mining generated ~$1.0 billion in FCF, 3.7% higher year-over-year (or YoY). The positive FCF in NEM’s latest quarter was its sixth consecutive quarter of positive FCF.

Newmont Mining expects cash flow generation to be fourth-quarter-weighted in 2018. Higher stripping in most of the regions Newmont operates in could lead to higher costs in the first few months of the year, leading to lower FCF generation.

Strong FCF generation going forward

Newmont Mining sees significant free cash flow (or FCF) generation over the next five years as it focuses on low-cost production. The company plans to divide the free cash flow between projects, exploration, and reinvestment in its business, as well as more dividends to shareholders.

Among its peers, Kinross Gold (KGC) has been generating decent FCF since 2015. Its ability to generate FCF might come under pressure due to its limited growth options.

Goldcorp (GG) has been lately generating negative FCF, mainly due to the changes in its working capital. Its projects and cost reduction should help generate significant FCF in 2018 and beyond. While Barrick Gold (ABX) generated 67% lower FCF YoY in 3Q16, it’s generating significant FCF due to lower costs.