These Factors Are Driving Analysts’ Estimates for Newmont Mining

Newmont Mining’s mean consensus revenue for 2017 is $7.3 billion. This implies year-over-year (or YoY) growth of 8.1%.

Dec. 25 2017, Updated 10:30 a.m. ET

Factors impacting Newmont’s estimates

The recent analysts’ estimates for Newmont Mining (NEM) are impacted by the company’s outlook on its production and costs going forward. Overall, analysts have turned more positive on the company’s fundamentals, given its focus on debt reduction, portfolio optimization, and cost-cutting.

Although 2017 has not been very good for Newmont Mining stock due to short-term issues, its outlook remains strong.

Analysts’ revenue estimates

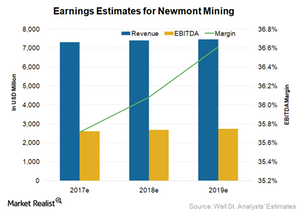

Newmont Mining’s mean consensus revenue for 2017 is $7.3 billion. This implies year-over-year (or YoY) growth of 8.1%. The company’s revenues for 2018, however, are expected to rise only 1.0%. This is expected given the company’s guidance of lower production due to higher stripping at many of its sites in 2018.

While new production from Merian and Long Canyon led to production growth in 2017, there isn’t any significant growth project coming online in 2018 to offset the decline from higher stripping and maturing operations.

In the long term, however, the company is expected to realize upside potential as its growth projects start coming online.

Earnings estimates

As we’ve discussed in previous parts of this series, Newmont Mining expects its costs to increase in 2018 before starting to trend lower. You can read Market Realist’s Why Newmont Mining’s Unit Costs Could Trend Higher Going Forward for more details.

Newmont Mining’s costs in 2017 were also high. Due to higher costs, analysts have estimated a flat EBITDA[1. earnings before interest, tax, depreciation, and amortization] margin for 2017 at 35.7%, similar to that for 2016.

In 2018 as well, the margins are expected to be marginally higher at 36.1%. Over the longer term, however, the company’s unit costs should trend downward as new projects with lower unit costs come into commercial production.

Newmont Mining’s peers (GDX) (RING) Barrick Gold (ABX), Goldcorp (GG), and Agnico Eagle Mines (AEM) have also trimmed costs considerably over the past year. Kinross Gold (KGC) has been less successful in reducing its costs.