Analysts’ Recommendations for Crude Tanker Stocks

In Week 28, analysts made no target price revisions or recommendation changes for crude tanker companies.

By Sue Goodridge

Dec. 4 2020, Updated 10:53 a.m. ET

Analysts’ ratings

In Week 28, analysts made no target price revisions or recommendation changes for crude tanker companies.

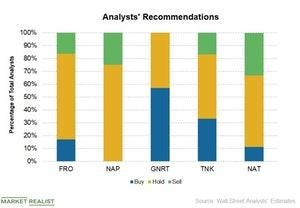

- Of the six analysts covering Nordic American Tankers (NAT), ~67% are neutral, recommending “hold,” while 33% are bearish, recommending “sell.” Their consensus target price of $2.45 implies a 6.56% downside to NAT’s current price of $2.43.

- Of the six analysts covering Frontline (FRO), 33% are bullish, recommending “buy,” ~33% are neutral, and 34% are bearish. Their consensus target price of $5.32 implies a 2.5% upside to FRO’s current price of $5.21.

- Of the ten analysts covering Euronav (EURN), 80% are bullish, and 20% are bearish. Their consensus target price of $10.89 implies a 26.6% upside to EURN’s current price of $8.50.

- Of the eight analysts covering Teekay Tankers (TNK), 50% are bullish, 37% are neutral, and 13% are bearish. Their consensus target price of $1.69 implies a 57.9% upside to TNK’s current price of $1.06.

- Of the 14 analysts covering DHT Holdings (DHT), 71% are bullish, and 29% are neutral. Their consensus target price of $5.31 implies a 15.6% downside to DHT’s current price of $4.59.

Article continues below advertisement