Comparing WTI’s and Brent’s Performance

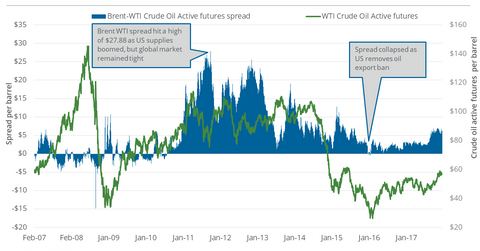

The Brent-WTI spread On December 18, 2017, Brent crude oil (BNO) active futures’ premium to WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.30. On December 11, 2017, the Brent-WTI spread was $6.70. On December 11, 2017, the shutdown of the Forties Pipeline System boosted Brent oil prices. That day, the spread expanded […]

Nov. 20 2020, Updated 11:44 a.m. ET

The Brent-WTI spread

On December 18, 2017, Brent crude oil (BNO) active futures’ premium to WTI (West Texas Intermediate) crude oil (USO) (UCO) active futures was $6.30. On December 11, 2017, the Brent-WTI spread was $6.70.

On December 11, 2017, the shutdown of the Forties Pipeline System boosted Brent oil prices. That day, the spread expanded by $0.66. The oil union’s strike in Nigeria, planned for December 18, 2017, also helped Brent outperform WTI crude oil. However, the strike has now been suspended.

Between December 11 and December 18, 2017, WTI crude oil active futures fell 1.4% and Brent crude oil futures fell 2%. WTI outperformed Brent, causing the Brent-WTI spread to narrow, as discussed earlier.

US oil exports

In the week ended December 8, 2017, US crude oil exports were at ~1.1 MMbpd (million barrels per day), a fall of 0.27 MMbpd from a week before. However, compared to the year prior, US crude oil exports rose ~0.6 MMbpd. An increase of $3.45 in the Brent-WTI spread over the same time period may have spurred US oil exports.

US oil producers’ (XOP) (DRIP) revenue from selling in the domestic market could be lower than that of their international peers because of a wider Brent-WTI spread. US oil producers output tracks WTI oil prices, while Brent is the benchmark for oil producers selling in international markets.

However, at the same time, the price difference between these two grades of oil could benefit US refiners (CRAK). Refined product prices follow Brent oil prices. Therefore, refineries could grow their profit margins by using US crude oil as their input. For crucial energy updates, visit Market Realist’s Energy and Power page.