How AbbVie’s Drugs Performed in 3Q17

In 3Q17, AbbVie’s (ABBV) Lupron generated revenues of around $201 million, which reflected ~4% growth on a year-over-year (or YoY) basis.

Oct. 31 2017, Updated 11:20 a.m. ET

Lupron revenue trends

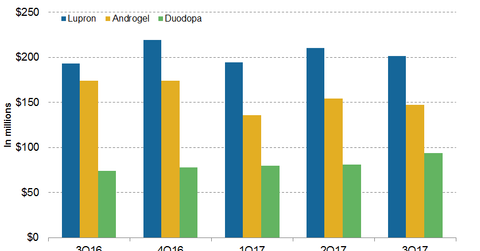

In 3Q17, AbbVie’s (ABBV) Lupron generated revenues of around $201 million, which reflected ~4% growth on a year-over-year (or YoY) basis and a ~4% decline on a quarter-over-quarter basis. In 3Q17, in the US market, Lupron generated revenues of around $161 million, which is ~4.1% growth on a YoY basis. In 3Q17, outside the US market, Lupron generated revenues of around $40 million, which reflected ~3.5% growth on a YoY basis.

Androgel, Creon, and Synthroid revenue trends

In 3Q17, Androgel generated revenues of around $147 million, a ~16% decline on a YoY basis and a 5% decline on a quarter-over-quarter basis. In 3Q17, Creon and Synthroid generated revenues of around $215 million and $191 million, respectively, which reflected ~14.8% and 1.5% growth on a YoY basis.

Duodopa and Sevoflurane revenue trends

In 3Q17, Duodopa generated revenues of around $94 million, which reflected ~26% growth on a YoY basis and 16% growth on a quarter-over-quarter basis. In 3Q17, in the US market and outside the US markets, Duodopa generated revenues of around $16 million and $78 million, respectively, which reflected ~56.4% and 21.5% growth on a YoY basis.

In 3Q17, Sevoflurane generated revenues of around $100 million, which reflected a ~2.7% decline on a YoY basis. In 3Q17, Sevoflurane generated revenues of around $19 million and $81 million, in the US market and in markets outside the US, respectively, which reflected a ~0.5% increase and a 3.4% decline on a YoY basis.

HCV franchise revenue trends

In 3Q17, AbbVie’s HCV (hepatitis C virus) franchise generated revenues of around $276 million. AbbVie’s HCV revenues represent the sales of the Viekira franchise. In 3Q17, AbbVie received US Food and Drug Administration approval for Mavyret. In 3Q17, AbbVie’s HCV drugs faced competition from Gilead Sciences’ (GILD) Harvoni, Sovaldi, and Epclusa, Merck’s (MRK) Zepatier, and Johnson & Johnson’s (JNJ) Olysio.

The growth in AbbVie’s sales could boost the SPDR S&P Dividend ETF (SDY). AbbVie makes up about ~1.7% of SDY’s total portfolio holdings.