Why Decreasing Credit Spreads Are a Cause for Concern

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

Nov. 29 2017, Updated 9:05 a.m. ET

The uncertainty about future rate hikes

The last two months have featured several important events impacting the interest rate scenario in the US. The new Federal Reserve chair, Jerome Powell, was confirmed and another rate hike is expected in December. The reaction of markets (BND), however, has not been uniform along the yield curve.

The November meeting’s minutes, which were published on November 22, indicated that the Fed members were still concerned about inflation (TIP) remaining low.

If future inflation expectations remain low, long-term yields would not move higher by the same percentage as short-term rates.

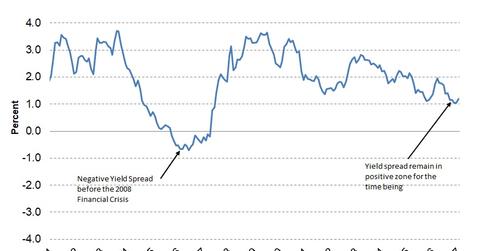

Such a situation leads to a narrowing credit spread, leading to a flattening of the yield curve and eventually an inverted yield curve. An inverted yield curve is a sign of future recession.

Yield spreads used in the Conference Board LEI

The Conference Board Leading Economic Index (or LEI), in its economic model, uses the credit spread between the ten-year Treasury bond (IEF) and the federal funds rate (TBF) as one of the components.

The November Conference Board report, which takes October data into account, reported the credit spread at ~1.2—an improvement from the September reading of ~1.1.

This brings the indicator marginally higher, and it had a net positive impact of 14% on the November LEI. The situation has since changed, and credit spreads have moved lower in November. The impact of this trend should be seen in the December report.

Outlook for credit spreads

The outlook for credit spreads is not a straightforward answer in the current economic climate. Future credit spreads would be dependent on inflation (VTIP) expectations, which are always subject to change.

Although the current communication from the Federal Reserve signals one rate hike in December 2017 and three more in 2018, inflation could remain below 2.0%. This disparity between rates and inflation could put further pressure on credit spreads.