US Dollar Survived Dovish FOMC Statement, Lackluster Jobs Report

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls.

Nov. 6 2017, Updated 6:00 p.m. ET

US dollar remained supported despite a dovish hike

The US dollar index (UUP) remained supported last week despite a dovish FOMC statement and a lower-than-expected rise in monthly non-farm payrolls. The US dollar index closed at 94.86 for the week ending November 3, posting a weekly gain of 0.04%. The key reason for the US dollar remaining supported was the relative dovishness of the other major central banks that announced monetary policy last week. The Bank of England raised interest rates by 0.25% but failed to confirm any future hikes, and the Bank of Japan left its ultra-loose monetary policy unchanged.

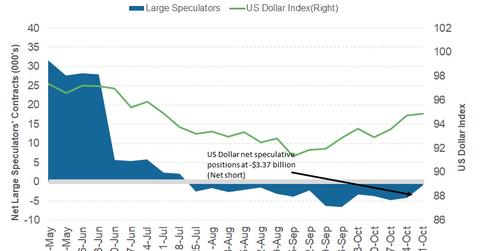

Speculators trimmed bearish bets last week

As per the latest “Commitment of Traders” (or COT) report released on November 3 by the Chicago Futures Trading Commission (or CFTC), large speculators and traders decreased their bearish bets on the US dollar and moved closer to neutral territory. Large speculator bets turned bearish in July after the US Fed was expected to stay put on future rate hikes.

As per Reuters calculations, net US dollar (USDU) short positions fell to -$3.37 billion, compared to -$8.02 billion in the previous week. This amount is a combination of US dollar contracts against the combined contracts of the euro (FXE), British pound (FXB), Japanese yen (FXY), Australian dollar (FXA), Canadian dollar (FXC), and Swiss franc.

Outlook for the US dollar

It’s a calm week for the market with no major market-moving economic data scheduled to be released from the United States or Europe. The market’s focus could remain on political issues in Saudi Arabia, which could have an impact on oil prices. Another source of volatility could be any unexpected comments from US President Donald Trump, who’s on an 11-day trip to Asia. Overall, the US dollar is likely to remain supported at the current levels for the week, and it would need a new dose of positive news to break higher.

In the next part of this series, we’ll discuss how bond markets have been impacted by the November FOMC statement.