The FOMC’s View of the Equity and Bond Markets

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons.

Nov. 29 2017, Updated 7:33 a.m. ET

How FOMC members assessed the bond markets

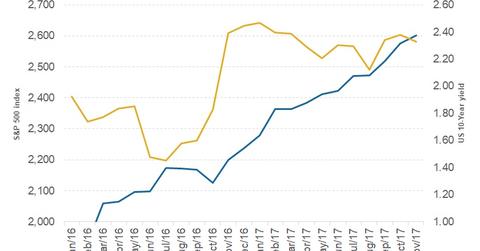

The FOMC’s November meeting minutes deemed the bond market’s yield curve to be flattening between meetings. The report indicated that bond yields have risen since the September FOMC meeting for multiple reasons. Apart from the prospect of rising interest rates, proposals for tax reforms and positive domestic economic data were other reasons for the rise in bond (BND) yields. The report said that markets had anticipated the plan for balance sheet normalization, which appeared to have a limited impact on Treasury yields and mortgage-backed security (MBB) spreads.

FOMC assessment of equity markets

FOMC members noted that the equity market indexes have risen in response to the increased likelihood of tax reforms. Equity markets (SPY) continued to register new peaks as investors remained optimistic that both the House and the Senate would pass tax reforms. As per FOMC observations, volatility (VXX) in the S&P 500 index remained near historical lows.

Less than two weeks remain before the Senate and House’s Christmas break, and they must resolve a few differences in order to pass tax reforms before the end of this year.

Conclusion: Doubts remain

The economic outlook and projections in the November FOMC meeting indicated that the FOMC was optimistic about the US economy. Doubts, however, remain as to whether these projections will prove true. First, there’s uncertainty about tax reforms. Second, there’s the unexplained low inflation (TIP). Finally, external uncertainties include geopolitical issues and slowing global growth. Markets and the Fed remain hopeful, but these doubts remain.