Saudi Arabia Could Help the Global Oil Market

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts.

Nov. 21 2017, Updated 11:35 a.m. ET

Production cuts and Saudi Arabia

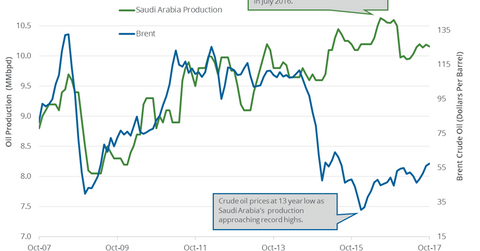

Russia and Saudi Arabia are major contributors to ongoing production cuts. Oil (BNO) (UCO) (DWT) prices have risen 30% since June 2017, partially due to OPEC’s production cuts. On November 16, 2017, Saudi Arabia’s energy minister signaled prolonging the production cuts at OPEC’s meeting. The meeting will be held on November 30, 2017. He added that production cuts are important to bring down OECD oil inventories below their five-year average.

Saudi Arabia’s crude oil production

The EIA estimated that Saudi Arabia’s crude oil production fell by 30,000 bpd (barrels per day) to 10,160,000 bpd in October 2017—compared to the previous month. Production fell 0.3% month-over-month and by 390,000 bpd or 3.7% year-over-year. Oil production fell due to ongoing production cuts. Saudi Arabia is the largest crude oil producer and exporter among OPEC producers. Any fall in production is bullish for oil (USO) (USL) prices. Higher oil prices benefit energy producers’ (FXN) (IYE) earnings like Shell (RDS.A), Saudi Aramco, Rosneft, and Cobalt International Energy (CIE).

Saudi Arabia’s oil exports to the US

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts. Exports to the US were at 1,500,000 bpd ten years ago, according to Bloomberg. The fall in exports led to the fall in US crude oil inventories to the lowest level since January 2016. Saudi Arabia’s oil exports to the US are expected to fall 10% in November 2017—compared to October 2017.

Saudi Arabia’s crude oil exports

Saudi Arabia’s crude oil exports to worldwide customers are expected to fall by 120,000 bpd in December 2017 from November 2017. Saudi Arabia’s crude oil exports were at 6.98 MMbpd in October 2017. Any fall in exports is bullish for oil (UCO) (SCO) prices.

Impact

Saudi Arabia is keen on a smooth exit from current production cuts. Any wrong move could bring excess oil back to the market. Many OPEC members are keen on extending the production cuts until December 2018. Longer-than-expected output cuts could support oil (DWT) (UWT) prices. However, any delay in prolonging the output cuts could pressure oil prices.

Next, we’ll cover some crude oil price forecasts.