Is Oil at the End of Its Rise?

On November 22, 2017, US crude oil (USO) (USL) January futures rose 2.1% and closed at $58.02 per barrel—the highest closing price in 2017.

Nov. 20 2020, Updated 1:39 p.m. ET

US crude oil

On November 22, 2017, US crude oil (USO) (USL) January futures rose 2.1% and closed at $58.02 per barrel—the highest closing price in 2017. The markets were closed on November 23, 2017, due to the Thanksgiving holiday.

On November 24, 2017, at 2:03 AM EST, US crude oil January futures were trading at $58.59 per barrel. It’s very likely that we could a see another 2017 high today.

However, fundamental drivers like the US oil rig count and growing US crude oil exports could threaten oil’s rally. Since OPEC’s production cut deal was announced on November 30, 2016, US crude oil production has risen by 80% of OPEC’s pledged output cut. The extra supply coming out of the US could undo OPEC’s efforts to boost oil prices.

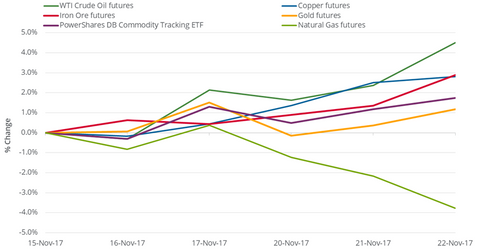

On November 15–22, 2017, US crude oil active futures rose 4.5%. The S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA) rose 1.3% and 1.1% during this period. Did oil help these equity indexes rise? We’ll discuss this in the next part.

Natural gas

In the seven calendar days to November 22, 2017, natural gas (UNG) January futures fell 3.8%. On November 22, 2017, natural gas prices fell 1.6%. The fall in natural gas inventories didn’t boost natural gas prices. Rising natural gas supplies could be dominating natural gas prices.