A Look at Oracle’s Cloud Enterprise Resource Planning Prospects

According to a new report by research firm MarketsandMarkets, the global enterprise resource planning (or ERP) market is set to expand at a healthy annual rate in the next few years.

Nov. 13 2017, Updated 9:02 a.m. ET

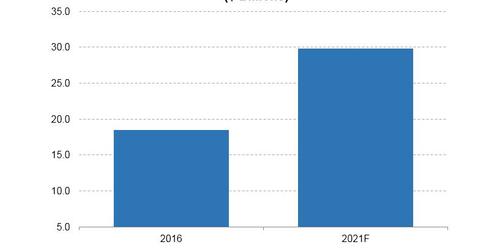

Cloud ERP expected to grow 10% annually until 2021

According to a new report by research firm MarketsandMarkets, the global enterprise resource planning (or ERP) market is set to expand at a healthy annual rate in the next few years. The global cloud ERP market was valued at a little over $18.5 billion in 2016, and it’s projected to increase to more than $29.8 billion by 2021, implying an average annual growth of 10% during the forecast period.

The healthy growth of the cloud ERP market should bring glad tidings to Oracle (ORCL). While Oracle isn’t the leading cloud vendor overall, research firm Gartner recently mentioned it as a leader in cloud ERP. Gartner describes cloud ERP leaders as those that have demonstrated characteristics such as a market-defined vision of how systems and processes can be supported and improved by migrating them to the cloud.

ERP gains are driving Oracle’s top line

Cloud computing and enterprise mobility are some of the factors driving growth of the cloud ERP market.

Oracle appears to be well-positioned for a strong demand for cloud ERP. While releasing its fiscal 1Q18 (August quarter) results, Oracle’s management stated that ERP is the company’s largest and most important cloud applications business. The company further said that it exited the latest quarter with 5,000 Fusion ERP customers and 12,000 NetSuite ERP customers on its cloud platform.

Gains in the cloud ERP market saw Oracle’s SaaS (Software as a Service) revenue rise 62% YoY (year-over-year) to $1.1 billion in 1Q18. That, in turn, boosted Oracle’s overall revenue to $9.2 billion, a 7.0% rise YoY, in the latest quarter.

How Oracle’s ERP rivals fared

In the ERP market, Oracle is competing for revenues with US-based (SPY) Microsoft (MSFT) and Workday (WDAY) and Germany-based (EWG) SAP SE (SAP). Microsoft reported revenue growth of 12% in fiscal 1Q18 (September quarter), Workday reported revenue growth of 40% in fiscal 2Q18 (July quarter), and SAP reported revenue growth of 4.0% in 3Q17.