Futures Spread: Is the Oil Market Tightening?

On November 7, 2017, US crude oil (OIIL) December 2018 futures settled $2.08 below the December 2017 futures.

Nov. 8 2017, Updated 12:04 p.m. ET

Futures spread

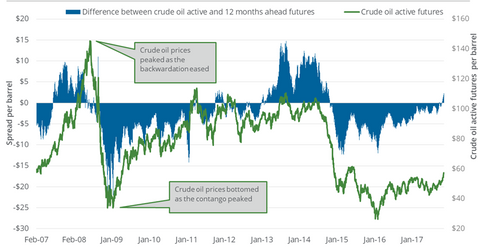

On November 7, 2017, US crude oil (OIIL) December 2018 futures settled $2.08 below the December 2017 futures. The difference between US crude oil December 2017 and December 2018 futures contracts is referred to as the futures spread. The futures spread was at a premium of $2.08. The 2017 contract traded higher than the 2018 contract. On October 31, 2017, the futures spread was at a premium of $1.38. Between October 31 and November 7, 2017, WTI (West Texas Intermediate) crude oil active futures rose 5.2%.

Backwardation

When the futures spread is at a premium (active futures trade at a higher price than contracts deliverable 12 months in the future), it’s called backwardation. In the past, when the futures spread was at a premium or the premium expanded, oil prices usually moved upward. The premium rose to $10.53 on June 20, 2014. That same day, active US crude oil futures settled at their highest closing price since that date. Oil futures in backwardation indicate a tight oil market and can cause prices to rise.

Contango

When the futures spread is at a discount (active contracts trade at a lower price than contracts deliverable 12 months in the future), it’s called contango. In the past, when the futures spread was at a discount or the discount expanded, oil prices were usually weaker.

The discount rose to $12 on February 11, 2016. That same day, active US crude oil futures settled at their lowest closing price in the last 12 years. Oil futures in contango can indicate that the markets are currently not tight but reflect the possibility of higher prices in the future.

What happened in the last 5 trading days?

Between October 31 and November 7, 2017, the futures spread premium rose, and oil prices moved higher. That could point to a tightening of the oil market.

Energy sector

US oil producers’ (XOP) (DRIP) (IEO) risk management techniques for their oil outputs may take into account the US crude oil futures’ forward curve. The curve can also impact midstream companies’ (AMLP) oil transportation and storage operations.

On November 7, 2017, US crude oil futures contracts for delivery until March 2018 settled at progressively higher prices.

Since this part of the futures forward curve is sloped upward, ETFs that are aiming to follow US crude oil futures may return less than oil futures in the months when this relationship exists. It could be one of the factors that limit the performance of the United States 12 Month Oil ETF (USL), the United States Oil ETF (USO), and the ProShares Ultra Bloomberg Crude Oil (UCO) compared to oil.