What’s the Short Interest in Marathon Oil Stock?

As of July 14, 2017, Marathon Oil’s (MRO) total shares shorted (or short interest) stood at ~51.8 million.

Aug. 1 2017, Updated 9:13 a.m. ET

Short interest in Marathon Oil stock

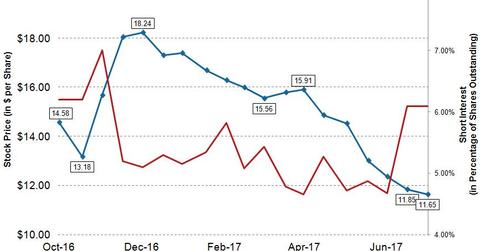

As of July 14, 2017, Marathon Oil’s (MRO) total shares shorted (or short interest) stood at ~51.8 million, whereas its average daily volume is ~15.5 million. This means the short interest ratio for MRO stock is ~3.34x. The average daily volume is calculated for the short interest reporting period from July 1, 2017, to July 14, 2017.

Marathon Oil’s short interest ratio has a 52-week high of 5.00x and a 52-week low of 1.51x. The stock’s short interest as a percentage of its 20-day average volume, 90-day average volume, and 180-day average volume is 3.42x, 3.63x, and 3.64x, respectively.

The current short interest in Marathon Oil’s stock as a percentage of shares outstanding is at ~6.1%. This figure is at the lower end when compared with many other upstream stocks from the SPDR S&P Oil and Gas Exploration & Production ETF (XOP).

As seen in the above chart, short interest in Marathon Oil stock as a percentage of shares outstanding has risen from ~5.3% to ~6.1% in 2017 despite a ~33% decline in MRO’s stock price during the same period. To learn more about MRO’s recent stock price performance, refer to the previous part of this series.

Other upstream players

Devon Energy (DVN), W&T Offshore (WTI), and Marathon Oil (MRO) have short interest as a percentage of shares outstanding of ~2.0%, ~7.4%, and ~6.1%, respectively. Just like Marathon Oil, both Devon Energy and Marathon Oil saw an increase in their short interest in the last one month. The Direxion Daily Energy Bull 3X ETF (ERX) is a leveraged ETF that invests in domestic companies from the energy sector.