Could US Dollar Recover This Week?

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain.

Nov. 21 2017, Updated 9:03 a.m. ET

US dollar continued to struggle

The US Dollar Index (UUP) continued to struggle as the fate of US tax reform remains uncertain. The US dollar index closed at 93.6 for the week ending November 17, posting a weekly loss of 0.74%. Though the tax reform bill has been approved by the US House of Representatives, the bill needs to be passed by the US Senate. The House and the Senate have proposed different versions of the bill, and investors remain concerned whether we’ll see tax reform soon. Economic data from the US was a mixed bag with retail sales failing to meet expectations while housing markets continued to improve.

Speculators added bearish bets on the US dollar

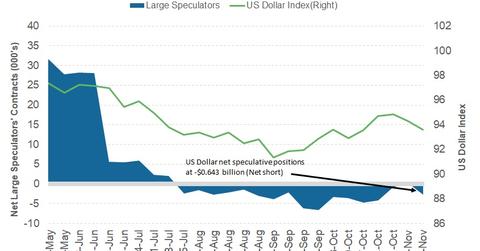

As per the latest commitment of traders (or COT) report released on November 17 by the Chicago Futures Trading Commission (or CFTC), large speculators and traders added bearish bets on the US dollar index last week.

As per Reuters’ calculations, the US dollar (USDU) net short positions decreased to -$0.64 billion as compared to -$1.9 billion in the previous week. This amount is a combination of US dollar contracts against the combined contracts of the euro (FXE), British pound (FXB), Japanese yen (FXY), Australian dollar (FXA), Canadian dollar (FXC), and the Swiss franc.

Outlook for the US dollar

In this holiday-shortened week, the US FOMC November meeting minutes will be the only major economic data release. The minutes are likely to reinforce the expectations for a December rate hike from the US Fed, which would be positive news for the US dollar. However, the ongoing uncertainty about tax reform is likely is keep the US dollar grounded. Weakness in the euro after the failure of coalition talks in Germany could lend support to the US dollar.

In the next part of this series, we will discuss how bond market investors are being troubled by yield curve flattening.