Bristol-Myers Squibb’s Valuation after 2Q17 Earnings

Bristol-Myers Squibb (BMY) met Wall Street analysts’ estimate for EPS at $0.74. It also surpassed the estimates for revenues.

Aug. 29 2017, Published 1:12 p.m. ET

Bristol-Myers Squibb’s valuation

Bristol-Myers Squibb (BMY), an American pharmaceutical company, focuses on innovative products for its Cardiovascular, Immunoscience, Neuroscience, Oncology, and Virology franchises. The company is headquartered in New York City.

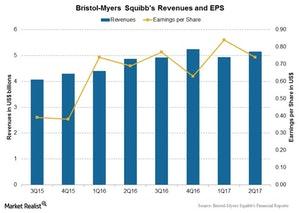

BMY met Wall Street analysts’ estimate for EPS (earnings per share) at $0.74. It also surpassed the estimate for revenue, reporting $5.14 billion compared to the estimate of $5.08 billion. Let’s look at the company’s key valuation multiples.

Forward PE

PE (price-to-earnings) multiples represent what one share can buy for an equity investor. As of August 28, 2017, Bristol-Myers Squibb (BMY) was trading at a forward PE multiple of ~18.7x compared to the industry average of 15.4x. Competitors Eli Lilly (LLY), Johnson & Johnson (JNJ), and Pfizer (PFE) are trading at forward PE multiples of 17.9x, 17.4x, and 12.4x, respectively.

Forward EV-to-EBITDA

On a capital structure neutral and excess cash-adjusted basis, Bristol-Myers Squibb currently trades at ~15.6x, which is much higher than the industry average of ~11.1x. Competitors Eli Lilly (LLY), Johnson & Johnson (JNJ), and Pfizer (PFE) have forward EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiples of 13.4x, 13.2x, and 10.2x, respectively.

Analyst recommendations

As of August 28, 2017, Bristol-Myers Squibb stock has fallen marginally by ~0.70% over the last 12 months. Analysts estimate that the stock will fall further by 1.0% over the next 12 months. Wall Street analyst recommendations show a 12-month target price of $57.86 per share compared to the last price of $58.37 on August 27, 2017. Of the 23 analysts covering Bristol-Myers Squibb stock, ten analysts recommend a “buy,” ten analysts recommend a “hold,” and three analysts recommend a “sell.” The consensus rating for Bristol-Myers Squibb is 2.43, which represents a “moderate buy” for value investors.

To divest the company-specific risks, investors can consider ETFs such as the First Trust Value Line Dividend ETF (FVD), which holds 0.50% of its total assets in Bristol-Myers Squibb (BMY).