Senior Gold Miners’ Earnings Beats and Misses in 3Q17

All the gold miners (RING)(GDX) we’re covering in this series except for Barrick Gold (ABX) reported earnings beats in 3Q17.

Nov. 20 2020, Updated 1:47 p.m. ET

Beats and misses

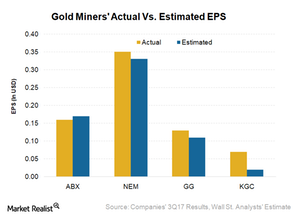

All the gold miners (RING)(GDX) we’re covering in this series except for Barrick Gold (ABX) reported earnings beats in 3Q17. The extent of the earnings beat and the reaction to respective stocks and misses varied. In this article, we’ll take a look at the major reasons for the beat and misses. We’ll also see which of these reasons are more fundamental in nature and which could keep affecting stock prices in the longer term.

ABX and GG: Muted stock price reaction

Barrick Gold (ABX) and Goldcorp (GG) released their results on October 25. While Goldcorp reported an earnings beat for 3Q17, Barrick reported an earnings miss. GG’s earnings per share (or EPS) of $0.13 beat market expectations by $0.02. Its revenues came in at $866 million, which also beat analyst expectations by $9.1 million. GG rose 0.3% on October 26 after the conference call. See Key Insights from Goldcorp’s 3Q17 Earnings for more details.

Barrick’s stock, on the other hand, fell 7.9% on October 26. Its EPS of $0.16 missed analyst estimates by $0.01. What was even more concerning for investors was the proposed framework with the Tanzanian government.

See 3Q17 Earnings: Will Barrick Gold’s Troubles End with 2017? for the results and outlook in more detail.

NEM and KGC

Newmont Mining (NEM) released its earnings on October 26 and recorded an earnings beat in 3Q17 after beating estimates in 1Q17 and 2Q17 as well. Its EPS came in at $0.35, beating estimates by $0.02. Even after delivering an earnings beat, the company’s stock fell 2.6% on October 26, probably because its costs were higher than expected. See How Will Newmont Mining’s 3Q17 Results Drive Its Future? for more information.

Kinross Gold (KGC), which was the last of these companies to report its earnings on November 8, recorded a strong earnings beat. It EPS of $0.07 were $0.05 higher than the analyst estimate. Its revenues also beat consensus estimates by $60 million, coming in at $828.0 million. The stock outperformed the broader gold miners’ index (GDX) as well as its peers by rising 4.5% on November 9. See Can Kinross Gold Sustain Its Price Momentum after 3Q17 Results? to find out more about its earnings and 2017 outlook.