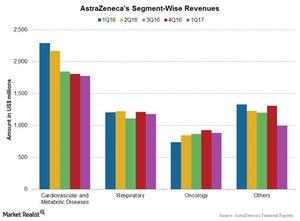

AstraZeneca’s Segment-by-Segment Performance in 1Q17

AstraZeneca’s (AZN) business is separated into four segments: Respiratory, Cardiovascular and Metabolic Diseases (or CVMD), Oncology, and Other.

May 29 2017, Updated 2:05 p.m. ET

AstraZeneca’s business

AstraZeneca’s (AZN) business is separated into four segments: Respiratory, Cardiovascular and Metabolic Diseases (or CVMD), Oncology, and Other Products. At constant exchange rates, AstraZeneca reported a 12% fall in its product sales at $4.8 billion in 1Q17.

Segment-by-segment performance

The performances of AstraZeneca’s four business segments are as follows:

- The Oncology segment reported a 21% rise in revenue at constant exchange rates. The segment’s revenue was $885 million, 16% of AZN’s total revenue, in 1Q17.

- The CVMD segment reported a fall of 22% in its revenue at constant exchange rates. The segment’s reported revenue was $1.8 billion in 1Q17, making it the largest contributor for AstraZeneca at over 32% of its total revenue.

- At constant exchange rates, the Respiratory segment reported flat revenue at $1.2 billion during 1Q17. However, due to the negative impact of foreign exchange, the segment’s revenue fell 2% during 1Q17. The segment contributed ~22% of AZN’s total revenue.

- The Other Products segment includes drugs from the infection, neuroscience, and gastrointestinal franchises. The segment’s revenue fell 25% at constant exchange rates to ~$1.0 billion in 1Q17. The segment includes blockbuster drugs Nexium and Synagis.

To divest risk, investors can consider ETFs such as the iShares S&P Global Healthcare ETF (IXJ), which holds 1.8% of its total assets in AstraZeneca. The iShares S&P Global Healthcare ETF also holds 7.7% of its total assets in Johnson & Johnson (JNJ), 3.1% in Amgen (AMGN), and 4.4% in Merck & Co. (MRK).