Why the Brent-WTI Spread Could Make Global Oil Supplies Rise

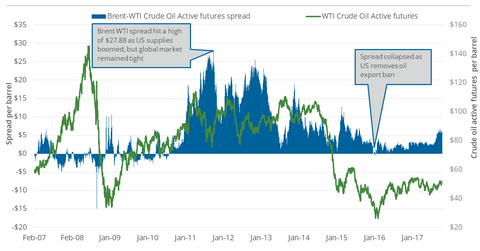

On October 17, 2017, Brent crude oil (BNO) active futures closed $6 above the WTI (West Texas Intermediate) crude oil futures.

Nov. 20 2020, Updated 3:26 p.m. ET

Brent-WTI spread

On October 17, 2017, Brent crude oil (BNO) active futures closed $6 above the WTI (West Texas Intermediate) crude oil futures. On October 10, 2017, the Brent-WTI spread was $5.69. From October 11–17, 2017, Brent crude oil active futures rose 2.2%, and WTI crude oil futures rose 1.7%.

Why a rising spread could increase global oil supplies

After the news of the Iraqi forces’ engagement in Kirkuk with Kurdish forces on October 16, 2017, the Brent-WTI spread expanded $0.28. The clash could take out 275,000 barrels per day of oil from the global oil supply, based on Bloomberg estimates. However, the rise in the spread could increase US crude oil exports, which were 1.3 MMbbls per day for the week ended October 6, 2017. A week before, exports were 2.0 MMbbls per day.

Every rise of just a penny in the Brent-WTI spread could compensate US crude oil exporters for their transportation costs to international markets.

But if the spread expands, US crude oil producers (XOP) (DRIP) (IEO) could get lower domestic prices compared to their international peers. However, it could be profitable for US refineries (CRAK) since input costs fall when output product prices are benchmarked to stronger Brent prices.

For more updates, be sure to track our Energy and Power page.