Why Eli Lilly’s Basaglar, Jardiance, and Trajenta Could Witness Steady Growth in 2018

In 1H17, Eli Lilly’s (LLY) Basaglar generated revenues of around $132.6 million, compared with $27.2 million in 1H16.

Oct. 18 2017, Updated 7:36 a.m. ET

Basaglar revenue trends

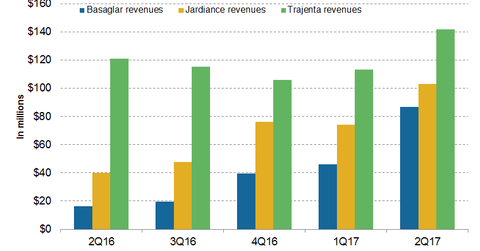

In 1H17, Eli Lilly’s (LLY) Basaglar generated revenues of around $132.6 million, compared with $27.2 million in 1H16. In 2Q17, Basaglar generated revenues of around $86.6 million, compared with $16.3 million in 2Q16. In 2Q17, Basaglar witnessed ~88% growth on a QoQ (quarter-over-quarter) basis.

The Basaglar (insulin glargine) injection is a human insulin analog used for glycemic control in individuals with type-1 diabetes mellitus.

Jardiance revenue trends

In 1H17, Jardiance generated revenues of around $177.2 million, compared with $78.3 million in 1H16. In 2Q17, Jardiance reported revenues of around $103.2 million, compared with $10.1 million in 2Q16. In 2Q17, Jardiance witnessed ~39% growth QoQ.

Jardiance (empagliflozin) is an SGLT2 (sodium glucose co-transporter 2) inhibitor used as an adjunct to diet and exercise for control of blood sugar level in individuals with type-2 diabetes and to reduce the risk of cardiovascular death in type-2 diabetes patients with an established cardiovascular disease.

In September 2017, Eli Lilly and Boehringer Ingelheim presented a new analysis of EMPA-REG Outcome trial, which demonstrated that Jardiance decreased the risk of cardiovascular deaths in adult individuals with type-2 diabetes and established cardiovascular disease.

Trajenta revenue trends

In 1H17, Trajenta reported revenues of around $254.9 million, compared with $215.4 million in 1H16. In 2Q17, Trajenta generated revenues $141.9 million, or reflected ~17% higher YoY (year-over-year) and 26% higher QoQ. Trajenta is used for controlling blood sugar levels in individuals with type-2 diabetes.

Basaglar, Jardiance, and Trajenta are jointly developed and commercialized by Eli Lilly and Boehringer Ingelheim. Eli Lilly’s peers in the diabetes care market include Novo Nordisk (NVO), Sanofi, Merck (MRK), AstraZeneca (AZN), Johnson & Johnson (JNJ), and Novartis. Notably, the iShares Select Dividend ETF (DVY) has ~1.07% of its total portfolio holdings in LLY.